Large-cap buyout

OTPP, KKR to buy Caruna from First Sentier Investors, Omers

Following deal completion, KKR and Ontario Teachers' will each own 40% in the company, followed by AMF Pension with 12.5%, and Elo Mutual Pension Insurance Company with 7.5%.

CVC Capital Partners buys Stark Group from Lone Star

GP paid around тЌ2.5bn for the company, deploying equity from CVC Capital Partners VII

FSN to acquire 45% stake in Obton

GP is reportedly paying тЌ403m for its stake, corresponding to a valuation of 25x profit for 2019

Silverlake buys Groupe Meilleurtaux from Goldman Sachs

UK-based GP reportedly paid €700m for its stake in the financial services company

Nordic Capital buys Siteimprove in first deal for latest fund

Nordic Capital X held a first close on тЌ5bn last month, and is now closing in on its тЌ5.75bn hard-cap

Advent International acquires stakes in Hermes UK and Germany

GP reportedly pays тЌ1bn for the two stakes in the parcel delivery firm

Advent acquires Evonik's methacrylates business for €3bn

GSO offered bidders a unitranche of €1.5bn and Barclays offered an all-loan structure of €1.25bn

Star Capital acquires ASL Aviation Holdings

Star Capital plans to wholly acquire ASL, which has been profitable every year since inception

Cerberus and Centerbridge offer €600m for NordLB

Firms will each pay half the offer price in a bid for a minority stake in the German lender

Record number of French SBOs and mega-deals in H1 2018

France's year is going from good to great as new figures from Unquote Data show buyout volumes reaching their highest level for a decade

Permira exceeds €7.25bn hard-cap on latest buyout fund

Permira VI held a final close in January 2017 after 11 months on the road

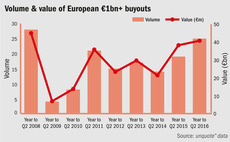

Southern Europe leads renaissance of billion-euro club

Dealflow in the тЌ1bn+ buyout segment reached an eight-year high across Europe in the 12 months to Q2 2016

Cinven's sixth buyout fund holds final close on €7bn

Vehicle will make тЌ150-600m investments across Europe, the US and Asia

EQT backs Nordic Aviation Capital in $3.3bn deal

EQT invests via Fund VI

Aggressive debt structures filter down from large- to mid-market

Debt landscape is rapidly changing, according to Marlborough Partners' latest report

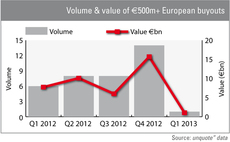

Large-cap activity gaining momentum in Q2

Welcome uptick at larger end of market, both for new deals and exits

Cinven tops up fifth buyout fund to €5.3bn

Cinven has held another final close on its fifth European buyout fund on €5.3bn.

Holding periods stretching amid tough exit environment

Holding periods

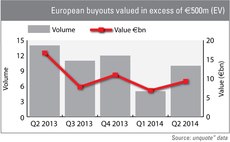

Large-cap market awakens after tepid Q1

European buyouts valued in excess of €500m have been conspicuous in their absence in the first quarter following a flurry at the tail-end of 2012 – but recent weeks have shown signs of a revival.

Springer Science sale back on

Germany could be home to another mega-buyout this year following news that EQT is in renewed talks with private equity investors over a potential sale of German publishing business Springer Science.

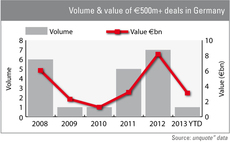

Germany: large-cap deals on the rise

CVC’s €3.1bn buy-back of German metering business Ista this month has sparked speculation about a revival of Germany’s large-cap market.

Marks & Spencer circled by Qatar-led consortium

Iconic British retailer Marks & Spencer could be the target of an ТЃ8bn takeover by a Qatar Investment Authority-led consortium, which could also include private equity players such as CVC, according to reports.

Cinven closes buyout fund on €5bn

Cinven has held a final close on its latest European buyout fund on €5bn.