Lower mid-cap renaissance for London in 2012

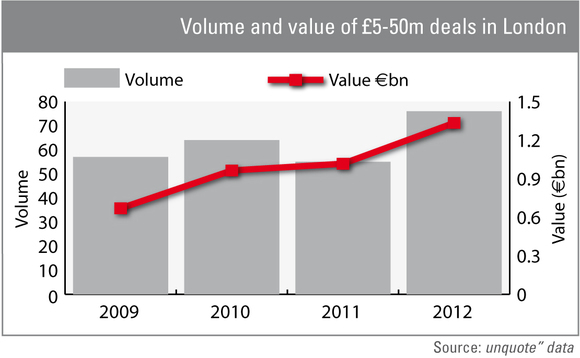

London was home to a noticeable dealflow uptick in the ТЃ5-50m segment last year, with both activity volume and overall value up by more than 30% on 2011 figures.

Private equity in the London area experienced a bit of a renaissance in 2012 following a disappointing 2011. Overall, 76 investments were completed in 2012 – a 38% increase year-on-year – and 16 buyouts and 10 expansion deals were added to 2011's total.

Looking at the longer-term picture, the level of private equity interest for London-based businesses has improved steadily since the dark days of 2009, bar the 2011 blip.

Overall value also experienced a welcome 31% uptick to settle at £1.3bn last year, on the back of strong transactions such as the £49m secondary buyout of BigHand by Bridgepoint. But the even more impressive volume increase meant that average deal value took a slight hit at £17.6m – not quite a match for 2011's £18.5m.

LDC, Bridgepoint and Electra Partners were among the firms that contributed to London's strong performance last year. Besides the BigHand SBO, notable investments in the lower size range included the growth capital injected into Park Resorts Group, Just Eat and Mimecast.

While buyout and growth capital dealflow kept improving in 2012, early-stage investments struggled to keep up with previous years: only four venture deals were recorded for the full year against nine in 2011.

This analysis is an extract from the latest unquote" Regional Mid-market Barometer, published in association with LDC. Click here to read the full report

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds