Buyouts

Lonsdale scores fourth exit of 2021 with Cross Rental Services sale

Sale of CRS is the GP's seventh exit since inception, and its fourth this year

Pamplona to acquire Pelsis from LDC

LDC backed the management buyout of Pelsis from US-based GP Wind Point Partners in 2017

Bain-led consortium enters discussions for Rolls-Royce's ITP unit

Bain-led consortium that includes local player Sener is poised to take over ITP with a EUR 1.6bn bid

Bridges reaps 2.5x return on sale of Wholebake to Elysian

Deal is the second investment for Elysian Capital III, which closed on its GBP 325m hard-cap in 2020

PAI buys PepsiCo US juice brands for USD 3.3bn

Deal also includes an irrevocable option to sell certain juice businesses in Europe

TriSpan buys Pho, Gresham House Ventures exits

Pho generated revenues of around GBP 40m in the year to February 2020

PAI acquires Scrigno from Clessidra

Deal is the fourth inked by PAI's new Mid-Market Fund, closed on EUR 920m in March

TA buys Smiths Medical from parent Smiths Group

Deal gives the medical subsidiary a USD 2.3bn enterprise value

Sanne board to recommend Apex offer

Should Apex make a firm offer, Cinven would have to significantly up its own bid for the fund administrator

Mayfair backs Tangle Teezer MBO

Report by The Times values the business at more than GBP 200m

HIG buys Quick Restaurants for EUR 240m

Restaurants reported EUR 227m in sales and EUR 21m in EBITDA in 2019

Livingbridge acquires IT service North from Aliter Capital

Aliter Capital formed North via a buy-and-build strategy for portfolio company Boston Networks

Wm Morrison shareholder JO Hambro to decline Fortress takeover offer

JO Hambro say the offer is below the 270p level that would be worthy of consideration

Cinven buys Restaurant Brands Iberia in EUR 1bn-plus deal

RB is the master franchisee for the Burger King brand in Iberia

Equistone sells Bruneau to Towerbrook

Earlier media report put the EV of the French online office supplies retailer at EUR 475m

Bregal acquires Advent-backed Laird Thermal Systems

Advent acquired LTS's parent company Laird in a GBP 1.2bn take-private in 2018

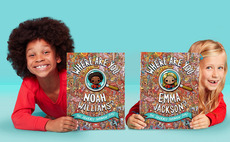

Graphite Capital acquires Wonderbly

Personalised children's books publisher is the seventh deal from Graphite's 2018-vintage ninth fund

Trilantic invests in Smile Eyes

Trilantic intends to pursue a buy-and-build strategy for the German ophthalmology clinic chain

Alpha Private Equity sells Vertbaudet to Equistone

SBO of the children's clothing and accessories retailer is Equistone's sixth platform deal of 2021

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Bayer ESP eyed by Bain, Cinven ahead of post-summer sale launch

Bayer could expect to fetch in excess of EUR 2bn for ESP, two sources say

A&M Capital Europe buys Pet Network for EUR 260m

Pet Network was created by TRG in 2018 through the acquisition and merger of three businesses

FPE invests in employee benefits software Zest

Deal is the 10th platform investment from FPE's GBP 100m, 2016-vintage, second fund

Palatine sells Wren Sterling in Lightyear-backed MBO

Wren Sterling was created in 2015 through the Palatine-backed MBO of Towergate Financial