Change of mind: Sponsors take to de-listing their own assets

"When events change, I change my mind. What do you do?," said either Paul Samuelson, Maynard Keynes or Winston Churchill. However, it could equally well apply to European sponsors in late 2023.

Private equity (PE) firms were enthusiastic about listing assets when Europe was at peace and interest rates were negative. Since then, a few have started to consider whether the assets that they listed are better off in private ownership.

EQT has become the first European PE to make a formal offer for an asset it listed in better times. It pitched an offer of EUR 16 per share for SUSE, as reported. It ended up with 76% of its capital following a mid-2021 IPO.

The offer values SUSE at EUR 2.72bn - a few hundred million short of the USD 2.5bn (EUR 2.3bn) EQT first paid for the company for in 2018; and a little more than half the EUR 5bn it was worth at the time of the IPO.

The move, which was predicted by Unquote's sister publication Mergermarket, followed rumblings of a similar deal for German-based laboratory group Synlab, which continues to be in discussion with sponsor and remaining largest shareholder Cinven (43%). No binding offer has yet been made, but the two remain in discussions months after the initial approach.

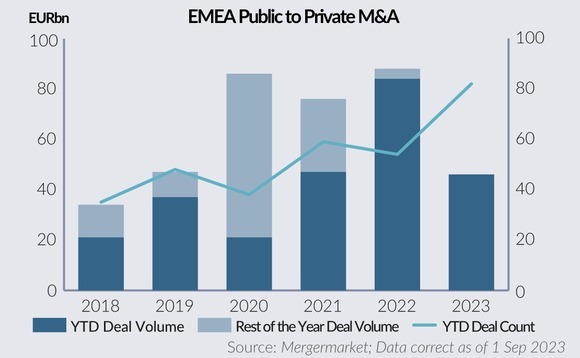

Elsewhere, sponsors have increasingly taken to take privates not already on their own books as a way boost deployment.

Reprocess

Both SUSE and Synlab had seen their share prices plummet since the listings, having faced general drops in indexes, pricing pressures and competition. SUSE was down 66% prior to EQT's offer and Synlab 64% before it announced the discussions.

EQT's reasoning follows a new wave of sentiment behind public-to-privates: the deal allows it to "work towards full potential in private setting" where the company can focus on value creation "without any short-term earnings focus and pressure from the public market".

PE ownership might also work better for buy-and-build platforms like Synlab, built through quick consolidation of Europe's laboratory diagnostics sector, due to its reliance on high capex spending.

Both companies have issued trading warnings this year. SUSE announced near flat revenue growth in Q2 due to delays in the completion of new contracts and a reduction in average contract lengths. Synlab revised downwards its 2023 targets with FY revenue figures expected to drop year-on-year 17% to EUR 2.7bn as COVID-19 testing dries up.

In both instances, returning to unlisted sponsor ownership will give more space to act on new growth plans.

Salvage yard

There are many sponsors sitting on large positions in underwater IPOs, where perhaps a new effort to delist the company is a better choice than lowly priced block trades.

Among them is Permira, which still owns a 36.4% stake in British shoe and boot chain Dr Martens where activist Sparta Capital recently built a top-ten shareholder position. The company's shares are down around 65% since its early 2021 IPO.

The sponsor still also owns 57.3% in French cybersecurity group Exclusive Networks, where shares are down 6% since listing and 24.9% in Polish e-commerce company Allegro. Cinven holds 24.9% of Allegro, while MidEuropa has 5.5%. All three are subject to a lock-up due to expire on 11 September.

Selected listed companies majority owned by sponsors:

| Pricing date | Company | Financial sponsors | % owned | Price since listing |

| 27-Jan-21 | InPost | Advent International | 30.33% | -46% |

| 29-Jan-21 | Dr Martens | Permira | 36.43% | -65% |

| 29-Sep-20 | Allegro.eu | Cinven; Mid Europa Partners; Permira | 55.28% | -60% |

| 14-Sep-20 | Max Stock | Apax Partners | 28.25% | -42% |

| 25-Feb-21 | Desenio Group | Verdane Partners | 25.19% | -98% |

When Synlab first announced discussions, many in the market worried at how Cinven would be able to convince investors of the need for a new strategy. However, EQT's move has now helped to add credence to the approach. With the equities markets so full of large sponsor positions, the two sponsors have set a bellwether for others to reclaim their assets.

Synlab's minority shareholders have already turned up their noses at Cinven's potential offer, while EQT is giving SUSE's the chances to roll into the new structure. Others may have different thoughts about being asked to buy high and sell low.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds