Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

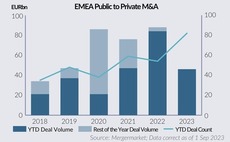

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater

EU FSR could impact PE fundraising with potential rise in 'clean funds'

FSR could lead GPs to create funds without foreign LPs; red tape around sovereign wealth funds likely

BHM Group builds on PE strategy, eyes European medtech and renewable energy acquisitions

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Redalpine expands leadership team amid CHF 1bn-plus fundraise

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Trind VC plans up to five early-stage investments in next six months

VC has deployed around 10% of its second, EUR 55m fund and plans to invest in up to 40 startups

Letter from the editor: Unquote is moving to Mergermarket

Unquote Editor Harriet Matthews outlines Unquote.com's upcoming move to the Mergermarket platform and the new capabilities and intelligence that this brings to Unquote readers

Ares Management handed keys to two-thirds of UK sponsor's portfolio

Lender provided GBP 500m for three of the GP's deals between 2016 and 2019, Debtwire reported

Actera Group explores strategic options for Celebi Ground Handling

Several investors placed bids for the company in 2022 but mismatch in pricing didn't lead to a deal

Iron Wolf Capital targets EUR 70m for second vehicle

Baltic investor anticipates early 2024 launch and will focus on early-stage AI and deeptech startups

Siena aims to hold new VC secondaries fund first close in late 2023 or early 2024

Secondary investments specialist will target EUR 30m to EUR 50m for new fund

IPO offers CVC chance to become multi-asset consolidator

Potential IPO also offers monetisation solution for founders and GP stakes investor Blue Owl

Main Capital's Assessio to be sold to Pollen Street

Recruitment software company tripled in revenue under Main Capital’s ownership

Norstat owner Triton Partners explores sale via William Blair

GP has owned the Norway-headquarterd market research business for almost four years

VC Profile: Possible Ventures lines up frontier tech deals halfway through fresh EUR 60m fundraise

Germany-based pre-seed investor is set to hold a first close for its third fund in mid-September

IK Investment-backed Eres expected to hit the auction block by 2024

French employee savings distribution and management firm could be valued at a few hundred million euros

Felss Group backer Capvis lines up PwC to guide sale process

Sale of German cold-forming specalist is under way, six and a half years into GP's holding period

Firstcom owner Oakfield mulls exit options via KPMG

The owners ofТ FirstcomТ are in the early stages of exploring a sale of the pan-European cloud telecoms provider, according to two sources familiar with the matter.Т

Credo Ventures sees activity uptick, plans further deals in 2023 with EUR 75m fourth fund

Czech VC firm's latest vehicle is around 50% deployed and expects to make 25-30 deals in total

Exponent divests 'significant' stake in Meadow to Canadian investor

Since 2018, GP has diversified food ingredients company's focus beyond commodity dairy

CMA scrutiny of high-leverage PE divestment purchases expected to increase

PE could stand to lose its historic advantage with heightened regulatory baggage

Mayfair Equity Partners poised to launch Nasstar sale in 1Q24

GP has pursued a roll-up strategy since acquiring IT services provider GCI in May 2018