Exits

Baird Capital exits Crisp Thinking to Kroll

GP invested GBP 19m for a minority stake in the social media monitoring firm in 2018

Ardian invests in TA Associates-backed Odealim

Sponsors will have co-control of the France-based insurance broker, with TA reinvesting

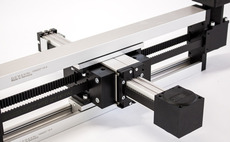

IK exits Bahr Modultechnik in EUR 98m trade sale

IK acquired the modular electric linear motion systems producer in 2018 via its Small Cap strategy

Bridgepoint acquisition of Dentego collapses

GP had entered into exclusive negotiations with vendor G Square following a Lazard-led process

Alcedo could launch Agrimaster sale in late 2022

Italian GP bought the agricultural machinery producer in 2017 via a EUR 30m SBO from B4 Investimenti

Livingbridge taps PwC to explore Helping Hands exit

GP acquired the UK-based home care provider from its founders in 2018 in a Deloitte-led auction

Five Arrows kicks off Laf Santé sale

Five Arrows has owned a majority stake in the France-based low-cost pharmacy chain since 2016

Hg's MEDIFOX sale launch draws large-cap sponsor interest

Hg acquired the software platform for care providers in 2018 from ECM Equity Capital Management

Sovereign Capital readies Nurse Plus for exit

Clearwater International hired to advise on sale of the UK-based healthcare staff agency

Perusa to exit Müpro in SBO to IK

Management of the German industrial fixings supplier will reinvest with a minority stake

MB Funds to exit Raksystems in sale to Trill Impact

New majority owner will seek to expand the Finnish green building services specialist across Europe

Monterro collects first round bids in Outpost24 auction

Swedish cybersecurity company could fetch around EUR 400m based off 8x-12x ARR

Sun European acquires DD Group in carve out from IDH

Vendor Palamon said deal is phase one of returning IDH to pureplay dentistry, will invest proceeds in M&A

Montagu launches Arkopharma sale; attracts PE and trade buyers

Bridgepoint and CVC’s Cooper among parties interested in the natural medicines and food supplements maker

Verdane scores 5x MOIC in partial exit of Inriver to THL

Majority investment from THL Partners sees Verdane retain a minority stake in the Swedish company

IK to sell 2Connect in SBO to Rivean

Management of the Dutch cable and connectors manufacturer will reinvest in the transaction

Ergon et al. sell Indo to PE-backed Rodenstock

Sherpa Capital and Oquendo Capital are also selling their stakes in the ophthalmic lenses producer

BC Partners, Cinven, Apax and Wendel circle Havea sale

French natural consumer healthcare manufacturer is set to collect non-binding bids next month

Horizon picks Moelis to advise on Sabio auction

Sale of UK digital customer experience transformation company is likely to launch in Q4 2022

Hg to sell Itm8 to Axcel, Chr. Augustinus Fabrikker

Danish IT services company will merge with Axcel-backed AddPro to form a new group with DKK 2.6bn revenues

PAI Partners to sell Perstorp to Petronas subsidiary

Acquisition by Malaysian group values the Swedish specialty chemicals company at EUR 2.3bn

Bravo Invest reaps 3x, 4.5x MM apiece in Arbo and MTW exits

With sales of Italian portfolio companies to NB Renaissance and DBAG, respectively, Bravo’s debut fund has now conducted four exits

Montagu appoints advisers to sell ophthalmology group Artemis

Goldman Sachs and HSBC will run the auction for the German company, with launching expected after the summer

Horizon Capital readies Digital Space for sale

Auction of the UK IT services company is expected to launch in the second half of the year