Industrials

IK pauses Ampelmann auction amid macro concerns

Buyer interest dampened by Dutch offshore access systems developer's exposure to Russia

Alto preps new vehicle as Fund IV deployment nears completion

Italian investor is preparing for new fund investing in Italian SMEs specialising in consumer, industrial, services and pharma sectors.

Aurelius exits German blown film maker Hammerl to trade

Distressed investor has sold company to German construction material manufacturer Karl Bachl

Advent begins Idemia premarketing ahead of summer sale launch

French biometrics specialist is expected to be marketed off EBITDA of more than EUR 200m

Synergia plans EUR 200m Fund VI final close by end of 2022

GP is targeting family offices and entrepreneurs and aims to hold a EUR 150m first close by the end of June

Alto Capital sells CEI Group to White Bridge

Vendor will reinvest with a minority stake in the automotive spare parts manufacturer via the same fund

Genesis holds EUR 150m final close for GPEF IV

Czech Republic-headquartered GP reached its hard-cap with a EUR 15m commitment from the EBRD

EQT, Mubadala to acquire Envirotainer for EUR 2.8bn

Vendors Cinven and Novo Holdings could opt to reinvest in the Swedish medical freight company as minority shareholders

SGT Capital at halfway point of USD 2bn fundraising ambition

USD 800m first closing coincides with regulatory approval for Utimaco acquisition

Advent and Lanxess form EUR 3.7bn polymers JV with Royal DSM carve-out

Buyers pay EUR 3.7bn for DEM; the new unit has sales of over EUR 3bn and EBITDA of EUR 500m

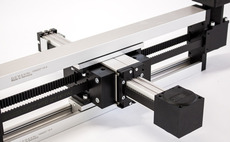

IK exits Bahr Modultechnik in EUR 98m trade sale

IK acquired the modular electric linear motion systems producer in 2018 via its Small Cap strategy

Sun European acquires Tenax

The sponsor invested through its latest fund, Sun Capital Partners VIII, acquiring an 80% stake.

GP Profile: Jet Investment doubles down on industrial impact ahead of next fundraise

Central European industrials-focused GP is in the planning phase for Jet 3 Fund and is eyeing further deals and exits

Alcedo could launch Agrimaster sale in late 2022

Italian GP bought the agricultural machinery producer in 2017 via a EUR 30m SBO from B4 Investimenti

Gemba Private Equity heads for EUR 25m close for debut fund

Spanish GP is looking to attract further LPs interested in the local mid-cap space

Silver Investment forms continuation vehicle for PTF

Selling investors have made returns of 6x their original investment in the precision parts producer

Perusa to exit Müpro in SBO to IK

Management of the German industrial fixings supplier will reinvest with a minority stake

Advent raises USD 25bn for GPE X

Around 40% larger than its predecessor, the new fund was raised in less than six months, managing director Johanna Barr tells Unquote

MB Funds to exit Raksystems in sale to Trill Impact

New majority owner will seek to expand the Finnish green building services specialist across Europe

B4 Investimenti on track for new fund launch in late 2023

Italian GP plans to hit the road for Fund III after the end of its current vehicle’s investment period

Mayfair buys majority stake in garage door group Garolla

Sponsor will seek to support domestic and European expansion of the companyтs D2C franchise model

Portobello Structured Partnership holds EUR 250m final close

Vehicle is the GP's first dedicated fund for minority stakes in Southern European mid-market companies

PAI Partners to sell Perstorp to Petronas subsidiary

Acquisition by Malaysian group values the Swedish specialty chemicals company at EUR 2.3bn

Andera Partners holds EUR 450m first close for Andera MidCap 5

Vehicle has a target of EUR 600m and is around 50% larger than its predecessor, Winch Capital 4