IPO

VC-backed Circassia valued at £581m for IPO

Largest LSE IPO of VC- or PE-backed UK healthcare company in decade

VC-backed King prices IPO, valued at $7.5bn

Company to net up to $612.72m from offering

IPO to value ISS at nearly €4bn

One million shares placed by EQT and Goldman Sachs

Warburg to reap 4.5x in Poundland IPO

Warburg Pincus is set to reap a 4.5x money multiple and an IRR of more than 50% in the flotation of portfolio company Poundland, which has been valued at ТЃ750m after setting its price range for its admission to the London Stock Exchange.

Mid-market players fear UK IPO disaster

Is the market approaching a bust?

VC-backed McPhy to float on Euronext

Company could raise up to €24.2m

Altor-backed OW Bunker plans flotation

Altor finds exit after seven-year holding

TPG reaps $479m in Lenta IPO

Russian hypermarket chain Lenta raised $952m in its IPO on the London Stock Exchange on Friday, with a market cap of $4.3bn and an enterprise value of $5.4bn.

VC-backed Horizon Discovery plans £25m IPO

Horizon Discovery Group, a Cambridge-based biotech backed by DFJ Esprit and Roche Venture Fund among others, is planning to raise ТЃ25m in its IPO on the AIM segment of the London Stock Exchange.

KKR's Pets At Home IPO to value company at £1bn

KKR-backed Pets At Home has set the price range for its IPO on the London Stock Exchange, valuing the company at more than ТЃ1bn.

Arle floats DX Group

Arle Capital Partners-backed DX Group has priced its IPO on AIM and will start trading this week.

Upcoming IPO to value Warburg-backed Poundland at £750m

UK discount retailer Poundland, backed by Warburg Pincus, has announced its intention to list on the London Stock Exchange.

VC-backed King files for $500m IPO

King Digital Entertainment, the venture-backed UK games developer behind Candy Crush Saga, has filed with the US Securities and Exchange Commission (SEC) for a $500m IPO on the NYSE.

TPG's Lenta to raise up to $1bn in IPO

Russian hypermarket chain Lenta, backed by TPG Capital and VTB Capital Private Equity, plans on raising up to $1bn in its IPO on the London Stock Exchange and Moscow Exchange.

Hellman & Friedman's GTT launches IPO

Hellman & Friedman-backed Gaz Transport & Technigaz (GTT), a French marine technology and engineering company, plans on raising up to €675m in an IPO on the Euronext Paris.

Deal in focus: uniQure raises $91.8m in IPO

Netherlands-based uniQure’s debut on the Nasdaq marks one of the latest in a string of European venture capital-backed biotechs flocking to the US markets, but the lack of activity in Europe's public markets does not necessarily equate to a slowdown in...

Stable markets and high liquidity to boost Nordic exits

The Nordic region saw disappointing dealflow in 2013, despite an open and liquid financing market - but the industry is upbeat on exit prospects for 2014. Karin Wasteson reports

Frog Capital backs RatedPeople.com pre-IPO round

Frog Capital and Western Technology Investment (WTI) have injected ТЃ6.5m into its portfolio company RatedPeople.com in a pre-IPO investment round.

VC-backed Egalet raises $50.4m in IPO

VC-backed UK pharma Egalet has raised $50.4m in its IPO on the Nasdaq, giving the company a market cap of $166.8m.

VC-backed Circassia to float on LSE

Circassia, a UK allergy treatment developer backed by several investors, has announced its plans to float on the London Stock Exchange (LSE) next month.

VC-backed uniQure raises $91.8m in IPO

Venture capital-backed Dutch gene therapy company uniQure raised well above its original expectation in its listing on the Nasdaq, bagging $91.8m.

HgCapital to reap 2.1x in Manx IPO

The IPO of HgCapital's Isle of Man-based telecoms operator Manx Telecom will give the company a market cap of around ТЃ160.2m and generate a 2.1x money multiple for its backer.

VC-backed Crossject to list on NYSE Alternext

French medical device company Crossject, backed by a consortium of local venture capital firms, is hoping to raise up to €12.9m in its IPO on the NYSE Alternext Paris.

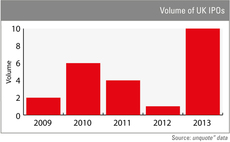

Fundraises to flotations: a promising year for the UK

The UK market witnessed swathes of fund closes and a surprising number of IPOs last year. But will this positive trend continue in 2014? Alice Murray reports