Permira

ProSiebenSat.1 sale fails to attract buyer

KKR and Permira’s efforts to exit German broadcaster ProSiebenSat.1 have hit a bump in the road as the buyout houses fail to find a buyer for their remaining shares.

Ex-Premier Foods boss to advise KKR on Lucozade and Ribena bid

KKR is understood to have brought in Michael Clarke, the former CEO of Premier Foods, to advise on its ТЃ1.5bn bid for Lucozade and Ribena from GlaxoSmithKline (GSK).

Acromas results spur further split speculation

Acromas, comprising AA and Saga and backed by CVC, Charterhouse and Permira, has reported a 4.9% uplift in EBITDA, reawakening speculation over how its financial backers will exit the business.

KKR and Permira free to exit ProSiebenSat.1

KKR and Permira have paved the way to exit German broadcaster ProSiebenSat.1 after shareholders approved a share conversion.

Altor and Bain acquire Ewos for NOK 6.5bn

Norwegian state owned-Cermaq has sold its Ewos division to Altor and Bain Capital for NOK 6.5bn.

Permira casts its net for Ewos

Permira has joined Bain Capital and Altor in the bidding war for Norwegian fish farmer Cermaqтs fish feed division Ewos.

Tax avoidance debate turns to private equity

Tax avoidance is top of the agenda for the G8 summit in Northern Ireland and part of that discussion will concern UK private equityтs treatment of corporation tax.

AA and Saga looking to refinance, then split

The AA group and Saga, backed by CVC, Charterhouse and Permira, are to issue a long-term bond to refinance £4bn of bank debt, which could lead to a break-up.

Permira sells more Hugo Boss shares

Permira is to sell seven million shares, or a 10% stake, in German high-end fashion house Hugo Boss, according to reports.

New Look launches £800m bond offering

Apax- and Permira-backed New Look Group has launched an ТЃ800m senior secured notes offering to pay down its debt.

Permira holds €2.2bn first close for fifth fund

Permira has raised тЌ2.2bn for its fifth buyout fund so far, just a third of the vehicleтs original тЌ6.5bn target.

Permira acquires PharmaQ

Permira has agreed to acquire Norwegian health group PharmaQ Holding AS for тЌ250m.

Apax, Blackstone, Permira and Providence fully exit TDC

The sale of TDC shows that not all investments made during the heady days leading up to the crisis were bad eggs.

In defence of private equity

There is increasing noise about unjustifiable fees in an industry that fails to live up to expectations. But this belies some outstanding performances and the promise of new opportunities, finds Kimberly Romaine

KKR to sell BMG stake to Bertelsmann

KKR is reportedly about to sell its 51% stake in joint music venture BMG to co-owner Bertelsmann.

Orix Corporation looking to buy Robeco

Japanese financial services firm Orix has confirmed that it is considering buying the asset management arm of Rabobank for up to €2bn.

Permira and KKR sell €485m ProSiebenSat.1 stake

Permira and KKR have sold shares in jointly-owned German media giant ProSiebenSat.1 on the Frankfurt stock exchange for €485m.

SVG Capital injects €100m into Cinven

Listed investment trust SVG Capital has committed тЌ100m to the latest fund managed by London-based GP Cinven.

Finding a way to exit the boom year deals

Many of the headline-hitting buyouts of the boom era are still sitting in private equity portfolios. Charles Magnay, partner at Altius Associates, looks at how GPs have adapted to exit large companies in the post-Lehman world.

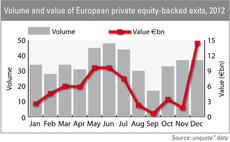

Exit market hits €15bn in December

Almost €15bn worth of capital was realised by private equity portfolio sales in December 2012, the highest amount in the past year, according to figures from unquote” data.

KKR and Permira looking to exit ProSiebenSat.1

KKR and Permira are looking to sell their stakes in German private broadcaster ProSiebenSat.1 to a trade buyer, according to reports.

Axa and Permira's Odigeo completes refinancing

Odigeo, the online travel agent backed by Permira and Axa Private Equity, has placed €325m worth of five-year secured bonds to refinance its senior debt.

CVC buys Cerved from Bain Capital and Clessidra for €1.13bn

CVC Capital Partners has acquired Italian business intelligence provider Cerved from Bain Capital and Clessidra for €1.13bn.