Secondary buyout

Premium buys Clarus from Pinova

Clarus's management team led by Norman Thom and Markus Mondani will remain invested

ProA Capital acquires Neoelectra in SBO

Sale ends a four-year holding period for Sandton, which bought the company out of insolvency

EQT sells Sportradar to CPPIB and TCV for €2.1bn

EQT will reinvest a portion of the sales proceeds and CEO Carsten Koerl will retain his stake

HQ Equita buys R2P and Open Access

Management teams of both companies will remain in their roles and retain significant stakes

Ardian backs paint-mixing machines business Corob

Company will use the fresh capital to bolster its growth both organically and through acquisitions

Adelis acquires Didriksons from Herkules

Deal marks the end of a four-year holding period for Norwegian private equity house Herkules

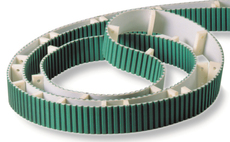

Partners Group buys Megadyne in SBO

Company's founders, the Tadolini family, reinvested in the business alongside Partners Group

ECI reaps 3.6x from Great Rail Journeys sale to Duke Street

Deal ends a five-year holding period of the luxury rail holiday provider for ECI

Bain Capital buys Italmatch in SBO

Sale ends a four-year holding period for Ardian, which acquired Italmatch from Mandarin Capital

Livingbridge sells Portman stake in SBO to Core Equity

GP sells its minority stake in the dentistry business after a four-year holding period

Polaris sells Louis Poulsen to Investindustrial

Polaris and merchants Hanssen and Droob first acquired, de-listed and relisted Louis Poulsen in 1999

Eurazeo buys ST Group in SBO

UI Gestion sells its stake in the sensitive areas security specialist, renamed Vitaprotech

Ergon Capital buys Indo in SBO

Sale ends a five-year holding period for Sherpa, which acquired the company after it hit bankruptcy

Cerberus buys WFS in €1.2bn SBO

Sale ends a three-year holding period for Platinum Equity, which bought the company from LBO France

MBO Partenaires buys BCF Life Sciences

GP takes over from Céréa Capital and Sodero Gestion, investing alongside management

EQT, PSP Investments buy Azelis in >€2bn deal

Apax is likely to generate a multiple in excess of 3.5x on the sale of its majority stake

CapMan sells The North Alliance to Norvestor

Norvestor will become majority shareholder following the acquisition from CapMan and management

MBO Partenaires buys-back Groupe LT

GPs Arkéa Capital, Amundi Private Equity and CEO Eric Van Acker acquire minority stakes

Ceder acquires Persson from Connecting Capital

Ceder acquired a majority stake of around 90% in the business, together with management

CVC's Delachaux foregoes IPO, acquired by CDPQ

Although an IPO price range was announced last week, CDPQ ultimately acquires the business

Advent buys Deutsche Fachpflege from Chequers

Current management team will retain a stake in the new company and remain in their positions

Adelis sells IT Relation to Hg

Deal ends a two-year holding period for Adelis, which established the business in 2016

BC Partners buys Forno d'Asolo in SBO

Company will use the fresh capital to bolster its growth organically and through new acquisitions

DBAG backs Karl Eugen Fischer in MBO from Equistone

Deal is the fourth MBO structured by DBAG Fund VII since it began deploying capital in 2016