Spain

Corus Dental sponsors mandate Houlihan Lokey to review options

Upcoming process for Spain-based dental prosthetics company to launch in September

VC Profile: RTP Global gears up to deploy largest fund to date, remains bullish on breakout opportunities

Partner Gareth Jefferies discusses early-stage deployment plans and advantages of supporting startups throughout their lifecycle

Fremman considers return to market in 2024 following newly closed EUR 1bn debut fundraise

Pan-European GP raised its debut fund during the тmost challengingт period for debut funds in recent years

AnaCap exits GTT to Stirling Square

Vendor will reinvest in tax collection software for a 20% stake; buyer makes second tech deal in a month

Portfolio Stock Exchange bets on uptick in PE fund listings

Exchange will initially seek Spanish closed-ended funds of EUR 40m-EUR 120m for listing

Alantra seeks to bolster US presence via buys, organic growth for advisory division - IB CEO

Financial services group aims to grow the geographical presence and sector specialism of its investment banking group

Bewater Funds nears EUR 7m close for second fund, aims to back 20 companies in next four years

Bewater II FCRE takes minority stakes (5%-25%) with tickets of EUR 500,000-EUR 2m, and it has already made three investments.

Alantra reshuffles investment banking division headed by new CEO

Miguel HernУЁndez takes on CEO role after more than 20 years with the financial advisory firm

Synova kicks off new fund deployment with Learnlight acquisition

Investment in Spanish edtech platform is the first from GBP 875m vehicle raised in three months last year

IK Partners mulls mid-term Southern European expansion

Spain, Portugal and Italy considered for future platform deals as the GPтs portfolio companies strengthen their foothold in the region

Nekko aims to reach EUR 10m hard-cap for N Venture I within six months

Spanish VC firm plans to build on the vehicle’s EUR 6m first close, with nine companies backed so far

PSG's Imaweb sale moves to second round

Sponsor bought a majority stake in the Spain-based car dealer and OEM sofware provider in 2019

Arcano holds EUR 450m final close for latest secondaries fund

With just under 50% deployed, the vehicle will split focus evenly between LP stakes and GP-leds

Arcano holds EUR 280m final close for impact fund-of-funds

Spanish GP is eyeing a second vintage in 2023 with the vehicle more than 50% deployed

William Blair launches Madrid office, adds investment banking practice in Zurich

Álvaro Hernández to lead new Spanish branch; healthcare will be first focus of Swiss expansion

Santander's Tresmares launches in UK with GBP 725m fund

GP has hired ICG's Philippe Arbour to lead evergreen fund that offers products including direct lending

Investindustrial aims for EUR 1bn close with third lower-mid cap fund

Lower-mid market strategy has sealed one first investment ahead of expected closing in coming months

GP Profile: Tikehau's Aerofondo set for aerospace industry take-off after first deal from debut fund

Spanish aerospace strategy aims to attract total commitments of EUR 150m-EUR 200m, with strategic LPs already in place

Advent invests PE-backed Seedtag with EUR 250m-plus deal

Deal for Spanish digital ads firm marks partial exit for Oakley Capital, Adara and All Iron Ventures

Miura Partners raises first EUR 150m impact fund

Spanish GP’s new vehicle will have its carried interest linked to portfolio companies’ impact goals as well as financial performance

Investindustrial to reap 2.5x money in Natra sale to CapVest

New owner will support Spanish chocolatier's organic growth and potential transformational acquisitions

Dunas Capital holds first close for debut impact fund

Vehicle plans to enter distribution partnership with private bank for its EUR 50m fundraise

Nexxus Iberia nets 4.2x on Bienzobas exit to trade

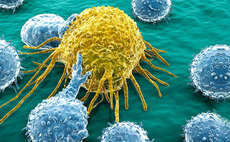

Sale of oncology group marks GP's second exit from debut fund; buyer Atrys pays 8.5x EBITDA

Aurica raises EUR 170m for fourth growth fund

Aurica Growth Fund IV will take minority stakes in companies with an EBITDA of around EUR 4m