Buyouts

IK-backed Klingel advances to round two with Altor among sponsors circling

Novo Holdings and AEA Investors also tipped to be in the final stretch for the German medical equipment company

Fondo Agroalimentare Italiano invests in Urbis Food

Deal marks the fund’s full deployment with more than EUR 50m invested across nine transactions

Eterus Capital lines up dealflow with EUR 10m left to deploy from EUR 40m fund

Slovak PE firm is “seriously looking at“ more than 10 potential investments

LDC generates 3.9x MM on MSQ sale to One Equity Partners

LDC to become minority investor following a doubling in revenues and tripling in EBITDA over four years

Main Capital exits Cleversoft to LLCP

Nordic Capital and OTPP's Mitratech were also in the running to buy the regtech platform, Mergermarket reported

Capvis-backed Gotha Cosmetics to grant PAI Partners exclusivity 'in coming days'

Capvis took a majority stake in the Netherlands-based colour cosmetics firm in 2016

Infobric sponsor Summa sees PEs including Nordic Capital, Blackstone prepare binding bids

GP bought Swedish construction tech provider in 2019 via its SEK 6.5bn, 2019-vintage Fund II

GP Profile: Limerston Capital anticipates higher volume but more complex M&A as market steadies

UK-based GP is seeing dealflow driven by carve-outs and buy-and-build in a market where organic multiple arbitrage is no longer a given

Mobilab signs deal with Armira in crowded small-cap auction

Founder-owned data applications and infrastructure provider drew sponsor and strategic interest

Carlyle acquires Meopta

GP plans to support Czech-American optical products manufacturer’s international expansion

Officine Maccaferri sees Cinven and Triton go head-to-head

Italy-based geotechnical and soil erosion control business could be valued at EUR 700m-EUR 800m

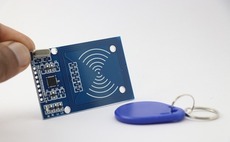

SGT Capital to acquire Summit-backed Elatec for EUR 400m

Mid-market sponsor looks to grow company via “continued technical innovation” and international expansion

Egeria to exit GoodLife Foods in SBO to IK Partners

Acquisition of Dutch frozen snack maker marks 13th investment from IK IX Fund

Permira to acquire majority stake in Gruppo Florence

Existing shareholders including VAM Investments and management of the Italian fashion group will reinvest, while Italmobiliare will exit

Gyrus Capital acquires LRE Medical from KPS-backed AIS Global

Carve-out of German diagnostic equipment manufacturer comes over two years after first sale attempt

ESI Group draws EQT, Hg, Thoma Bravo interest

Listed French industrial software maker has drawn wide interest from sponsors and strategic players

Ambienta finalises third fund deployment with Gruppo Spaggiari Parma acquisition

Italian GP is investing in the educational software group in a primary deal from its EUR 635m, 2018-vintage fund

BC-backed VetPartners sees initial bids fall short of price expectations

Ongoing buyer and seller valuation expectation gap has hit the sale of the vet clinic chain, sources said

Wellspect auction in final stretch with Blackstone, EQT and KKR to battle it out

Owner Dentsply launched a process to sell the Swedish bowel and bladder control products specialist in February

Emerging manager Px3 makes first acquisition with carve-out buyout

RhУДne Group spin-out makes inaugural acquisition with Celeros Flow Technologyтs filtration unit buyout

PAI Partners to acquire The Looping Group from Mubadala Capital

GP will take a majority stake in French leisure park operator via its latest flagship vehicle, PAI Fund VIII

Sullivan Street carves out Tracerco from Johnson Matthey for GBP 55m

Fourth exit attempt for oil diagnostics arm garners 6.8x EBITDA sale multiple, family office Souter joins ticket

DAC Beachcroft hands exclusivity to Limerston for Claims Solution Group carve-out

UK-based sponsor Limerston Capital could close a deal in the coming weeks following a formal auction

Germany's DFL to collect NBOs for EUR 3bn media rights stake

Large-cap sponsors including Advent, Blackstone, Bridgepoint, CVC, EQT and KKR expected to bid today