Exits

Endless exits Carpet & Flooring in trade sale

GP acquired the carpet and flooring division of listed building products company SIG in early 2017

Parsley Box floats in £84m IPO, Mobeus reaps 4.2x return

Mobeus sells one third of its holding, while remaining as the largest institutional shareholder in the business with a 14% stake

Mid Europa acquires MCI-backed e-commerce platform Pigu

MCI will reinvest in the deal, which also sees Pigu merge with Estonia-headquartered Hobby Hall

Bregal to acquire Afinum's Perfect Drive Sports Group

Bregal announced the deal in conjunction with the €1.875bn close of Bregal Unternehmerkapital III

EQT in exclusivity to acquire Cerba from Partners Group

Medical diagnostics business has previously been backed by sponsors including Astorg, IK and PAI

Astorg buys majority stake in Five Arrows-backed Opus 2

Five Arrows bought a minority stake in the legal technology company in 2017 and will now reinvest

Astorg in exclusive negotiations for CVC's Corialis

SBO will be the fifth PE buyout for the aluminum door and window systems producer since 2004

CapVest sells Eight Fifty to Sofina Foods

Combined group is expected to employ 13,000 staff across 44 sites and generate $6bn in annual revenues

Nordic Capital nets strong return on €2.1bn Itiviti trade sale

GP had delisted the trading technology and services provider in 2012

BIP management presentations ongoing, with strong PE interest

Apax acquired a 60% stake in the business from private equity firm Argos Wityu in early 2018

Procuritas to net 8x on Pierce IPO

GP acquired the online motorcycle parts and accessories retailer in 2014

Semantix owner Segulah preps exit with William Blair

Semantix was originally established in 1969 and was acquired by Segulah in 2015

H2 Equity readies Brink exit with Houlihan Lokey

Brink will be marketed based on EBITDA of more than €25m, according to one source

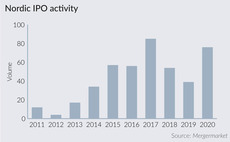

Nordic IPO rush drives exit opportunities for GPs

Wave of Nordic IPOs shows no signs of receding this year, often driven by new opportunities emerging from the pandemic

TDR Capital acquires BPP from Apollo's Vanta Education

Vocational course provider BPP was acquired by Vanta Education in 2009, prior to Apollo's investment

Vallis sells Imperial to trade

Sale ends a six-year investment period for Vallis, which invested in the business via Vallis Sustainable Investments I

Hg sells Trace One to Symphony Technology Group

Hg invested in the retail and branding management software in 2016 via HgCapital Mercury Fund

Activa sells Active Assurances to Silver Lake's Meilleurtaux

Sale ends a three-year holding period for Activa, which invested in Active Assurances alongside BPI France

TA Associates, Partners Group buy Unit4 in $2bn deal

Sale ends a seven-year holding period for Advent International, which took Unit4 private in a €1.2bn deal

SEP sells Dotmatics to Insight Partners' Insightful Science

Scottish Equity Partners invested in the scientific informatics software in 2017

Triton reaps 2.4x return on sale of Logstor

Deal comes more than seven years after Triton invested in Logstor via Triton Fund III

Bridgepoint sells US-based Calypso to Thoma Bravo

Deal values the financial services software firm at $3.75bn, according to several media reports

Inflexion sells Kynetec to Paine Schwartz Partners

Fourth exit in four months sees the GP net returns of more than 3x money and a 25% IRR

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe