Nordic IPO rush drives exit opportunities for GPs

The wave of Nordic IPOs shows no signs of receding this year, often driven by new opportunities emerging from the pandemic, but local players warn that success is not always a given. Eliza Punshi reports

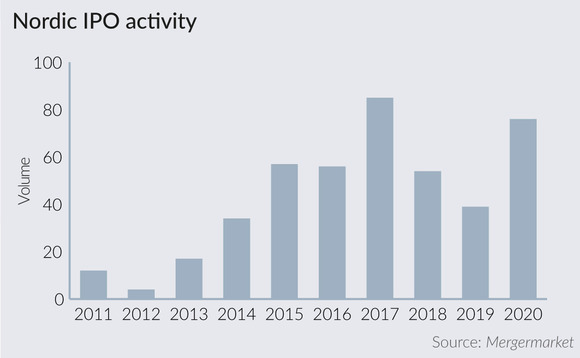

According to Mergermarket data, there were 75 IPOs in the Nordic region in 2020, the second highest figure in the past decade after 2017. These public market listings were dominated by digitial consumer, software-as-a-service and e-commerce companies, all of which have shown resilience during the pandemic.

The trend has persisted so far in 2021, with PE-backed companies Cint, Desenio and Fractal Gaming Group being listed in Q1. On 26 March, Procuritas announced the successful SEK 2.5bn IPO on Nasdaq Stockholm of Pierce Group, an e-commerce company selling spare parts, accessories and streetwear for motorcycles and snowmobiles.

Verdane partner Henrik Aspen says: "The impact of the pandemic on the digital consumer sector has helped a lot of companies reach a different level of maturity in terms of size and profitability, which makes it possible for them to go public." He says the GP grew wall art retailer Desenio from SEK 100m in revenues to SEK 1.3bn, with retained profit margins exceeding 25%, prior to listing it earlier this year.

At least 50 other Nordic companies are eyeing a stock exchange float for 2021, including oat milk maker Oatly, fintech company Trustly, and caller ID and spam-blocking app Truecaller.

Tom Henriksson, general partner at software-focused venture capital firm OpenOcean (a backer of TrueCaller), thinks IPOs are appealing right now. He says: "From a TrueCaller perspective, it's because they had a great last year. The business has grown a lot in the second half of 2020 and continues to grow very fast. It is a profitable company and is now in a place where it can do a serious IPO."

In addition to liquidity, publicly listing a company brings about brand awareness for it, says Aspen. He says: "It gives the company a stamp of quality. Over time, the potential for increased brand awareness can benefit the company's business."

Even so, Verdane only considers the IPO route for companies of which the GP would like to be long-term owners, divesting 50% of its stake when going public but staying on as owners for a long time afterwards. "For us, it is about whether it's a company we're proud of, whether it can and deserves to be a listed company, and that when we fully exit our holding, whether it will continue to deliver according to plan," says Aspen.

Upcoming PE-led IPOs of Nordic companies

|

Company |

Company description |

Significant owners |

|

Oatly |

Manufacturer of oat-based, non-dairy food products |

Verlinvest and China Resources (65%) |

|

Trustly |

Provider of online payment products to online merchants and electronic marketplaces |

Nordic Capital |

|

Epidemic Sound |

Subscription-based provider of royalty-free music |

EQT |

|

Truecaller |

Developer of mobile apps |

OpenOcean |

|

Revolution Race |

Retailer of outdoor clothing |

Altor |

|

Komplett |

Online retailer of computer products and consumer electronics |

Canica |

|

Trifork |

Developer and seller of IT solutions and software |

Gro Capital |

|

Hemnet |

An online real estate classifieds platform |

General Atlantic |

|

Elopak |

Supplier of carton packaging and filling equipment for liquid food |

Ferd |

Source: Mergermarket

Alternative thinking

For VC-backed companies seeking liquidity, it can be sought in other ways, says Ekaterina Almasque, general partner at OpenOcean: "I've been fighting this perception that in Europe there is a lack of liquidity, which is why there we see these non-traditional ways, either early exits for many companies or this wave of IPOs." She adds that the path of IPO should not be taken too readily: "For very innovative companies, the path of early IPO can be a dangerous one, because it puts all types of pressures on the companies and takes them away from the real goal."

Instead, Alsmasque says accessing growth capital should be the first port of call. "Many big PE players or large sovereign funds today have capital for growth, and this should be the first way to go so that we can build these companies up."

With valuations in some sectors currently through the roof, Aspen thinks that in the future the market might see companies where owners have initiated sales processes a couple of times but have been unable to progress, perhaps due to outsized value expectations, and then move to go public. However, he says, for any such public listing to be successful, "it is imperative that buy-side advisers do their homework to really see if the company is positioned for future growth, or if the deal simply reflects a very hot market".

On the sell-side, apart from general considerations such as ensuring the company is prepared for baseline reporting requirements, companies also need to consider their market before listing, how it will develop going forward, and how predictable their business models are. Aspen says: "Public investors love quality, and they love companies with an ability to predict preferably stable and growing earnings. If you can prove that to investors, I think you will have an attractive company to go public with."

Additionally, the exchange on which the company is being listed needs to be big enough to support the long-term growth of the company. Henriksson says it makes sense for GPs to wait to list them on an exchange where they know there is liquidity: "If the company is a $1bn company or $10bn-plus company, it needs to list on a large exchange with lots of actors."

Even as people resume travelling and reallocate a portion of their budgets on things they currently can't spend on, Aspen believes that the migration from offline – a trend that was driving significant growth in Verdane's portfolio even before the pandemic – is here to stay. He therefore expects a sustained uptick in tech and e-commerce listings over the next couple of years.: "There is a lot of capital available, and with the SPAC trend arriving in Europe, investor appetite for digital consumer companies is likely to remain large for now."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds