PIPEs

Sherpa Capital backs Dogi

Spanish special situations investor Sherpa Capital has committed €3.8m to listed fabrics manufacturer Dogi International Fabrics.

CM-CIC, Seventure in €23m Global Bioenergies capital increase

Industrial biology company Global Bioenergies, listed on the NYSE Alternext Paris, has raised €23m through the placement of 927,419 new shares.

BNP Paribas et al. invest in Systar

Systar, a French provider of operational intelligence software, has completed a €2.35m private equity offering.

Investor AB backs Active Biotech with SEK 270m

Investor AB has agreed to buy six million newly-issued shares in Active Biotech, providing the company with SEK 270m in total after transaction costs.

PineBridge invests €26m in Work Service

PineBridge Investments has acquired a 20.02% stake in listed Polish staffing and personnel business Work Service for €26m.

DBAG increases Homag stake

Deutsche Beteiligungs AG (DBAG) has increased its stake in listed German portfolio company Homag Group AG from 33.1% to 39.5%.

Advent buys 55% stake in EKO Holding

Advent International has agreed to buy a 55% share in Polish supermarket chain EKO Holding from majority shareholders Krzysztof and Marzena Gradecki.

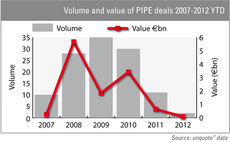

Stock markets blocking the PIPE

The number of investments by private equity funds in publicly traded shares has fallen significantly in the past two years as the stock market has detached from measures of GDP, according to figures from unquote” data.

A Capital in DKK 185m PIPE for Bang & Olufsen

A Capital and Chinese luxury retailer Sparkle Roll have invested DKK 185m for a 7.71% stake in listed Danish high-end audio-video business Bang & Olufsen.

Pamplona increases stake in UniCredit Group to 5%

Pamplona Capital Management has increased its stake in banking group UniCredit by 3.02%, making it the second largest shareholder with a total of 5.01% of the group.

Vector wins Technicolor battle

US private equity house Vector Capital has seen its offer for a minority stake in troubled French digital video specialist Technicolor accepted by the company's shareholder - pipping JP Morgan to the post.

Blackstone acquires Leica

Blackstone Group has acquired a 44% stake in German camera equipment producer Leica Camera.

Agri Investment Fund CVBA invests in PinguinLutosa

Agri Investment Fund (AIF) has acquired KBC Private Equity’s stake in listed Belgian frozen vegetables specialist PinguinLutosa in a deal thought to be worth around €8.5m.

First Reserve invests €300m in Abengoa

US private equity firm First Reserve Corporation has invested €300m in listed Spanish technology company Abengoa as part of a capital increase.

DPE invests in First Sensor

DPE has invested in developer and manufacturer of individual sensor solutions First Sensor Technology, providing a capital increase of €33m.

CapMan invests in B&B Tools

CapMan has invested in Nordic industrial tools producer B&B Tools AB to hold 6% of the outstanding shares.

KKR makes takeover bid for Versatel

Global private equity house KKR has made a voluntary public takeover offer worth €242m for telecommunication service provider Versatel.

Cinven to take a further 30% of Camaïeu

Modacin France, a holding company owned by Cinven, has offered to acquire a further 30% of listed French clothing company Camaïeu and now plans to take it private.

Gimv invests €60m in PinguinLutosa

Gimv has made a €60m PIPE investment in listed Belgian frozen food producer PinguinLutosa.

Idea Capital invests £7.5m in Telit Communications

Idea Capital has invested £7.5m in listed Italian telecoms business Telit Communications, as part of a wider £19m capital increase for the company.

Warburg Pincus invested in United Internet

Private equity investor Warburg Pincus has acquired 5.29% of the shares in United Internet AG.

Cleantech Invest AG et al. complete $10.35 PIPE deal

Cleantech AG and a group of institutional investors have invested $10.35m in listed technology company Identive Group.

Altor accquires stake in Eltek

Altor Equity Partners has acquired a 16.5% stake in Eltek ASA, a Norwegian listed global power conversion and microwave transmission specialist.

Ahlström Capital invests in Cencorp

AhlstrУЖm Capital has committed to investing in Cencorp, provided certain conditions are met.