Stock markets blocking the PIPE

The number of investments by private equity funds in publicly traded shares has fallen significantly in the past two years as the stock market has detached from measures of GDP, according to figures from unquote” data.

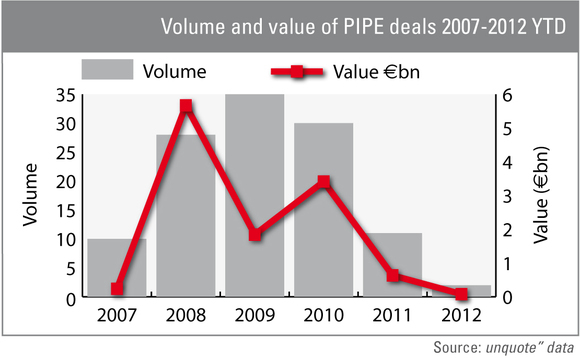

Analysis of private investments in public equities – otherwise known as PIPEs – shows the practice boomed during the height of the recession in 2009, but has eased off following unusual trends in global stock exchanges. As the graph above shows, the number of share investments by private equity funds reached 35 in 2009, a time of extremely difficult deal-doing.

However, the trend is clearly linked to stock market performance, with the FTSE All Share reaching a trough at just 1,789 in March of that year. The same was seen elsewhere, with the CAC 40 falling to 2,534, while the NASDAQ plunged to 1,064.

There were a number of factors driving this development. Firstly, a lack of leverage was making it difficult to acquire whole companies through buyouts. With large amounts of capital to deploy from funds raised immediately prior to the crash, it made sense for many to start putting their cash to work on stock markets as primary exclusive deals proved elusive.

Secondly, with stock markets sharply down and many stocks potentially undervalued, private equity funds were able to pick up significant stakes in listed firms at huge discounts. Fund managers will have been hoping to make a decent return from the cash put to work, as well as potentially gaining a foothold for future take-private deals.

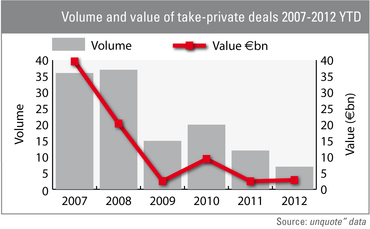

As the stock market recovered following 2009, PIPE deals have tailed off, but the economy remains depressed, and as such there have been few significant take-privates as firms continue to struggle to raise the sort of financing needed to take major listed companies off the market.

It would seem the stock market has decoupled from the real economy. Today the FTSE All Share is at 3,010, the CAC 40 has reached 3,489 and the NASDAQ stands at 2,788. Those major listed corporates that hoarded cash during the initial recession and have survived are now paying this capital out to their shareholders as dividends. This is driving up the value of shares even while the world slips back into recession.

This does not bode well for private equity. While normally a recession might provide opportunities to pick up undervalued listed firms at bargain prices, the growing disparity in listed stock performance and real economy means this route can no longer be relied upon in an environment where good deals are becoming increasingly hard to come by.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds