Venture

Active Venture Partners holds final close on €54m

Active Venture Partners has closed its second technology fund on €54m.

Latvian Guarantee Agency seeks managers for local VC funds

State-backed Latvian Guarantee Agency (LGA) has launched a tender to select up to three managers for recently established VC funds.

Inveready launches €15m technology fund

Spanish investor Inveready has launched a €15m fund to back technology companies.

Spain's CDTI to launch two venture vehicles

Spain’s Centre for the Development of Industrial Technology (CDTI) will soon launch two venture capital vehicles with capital commitments totalling €150m, according to reports in the Spanish press.

Evonik invests in Pangaea Ventures fund

CVC-backed German speciality chemicals maker Evonik has invested in Pangaea Ventures Fund III through its recently established venture unit.

EIF commits €17m to Lithuanian SME funds

The European Investment Fund (EIF) has committed тЌ11m to the Practica Venture Capital Fund and тЌ6m to the Practica Seed Capital Fund.

BV Capital rebrands as e.ventures

Global venture firm BV Capital has combined its five local funds into a unified international entity named e.ventures.

EdRIP raises €125m for fourth life sciences fund

Edmond de Rothschild Investment Partners (EdRIP) has held a first close for its BioDiscovery 4 fund on €125m.

Advent Life Sciences gets re-up for latest fund

Advent Life Sciences Fund I, a 2010 vintage venture vehicle managed by Advent Venture Partners, was reopened to accept a new commitment as well as increased investments from existing LPs.

Braemar Energy Ventures closes third fund at $300m

Braemar Energy Ventures has closed its oversubscribed third fund on $300m.

Index Ventures closes €350m tech fund

Index Ventures has raised a €350m fund aimed at early-stage investments in the technology sector, Early Stage Fund - IV6.

First close for ISAI's second FCPR fund

French venture capital firm ISAI has held a first close for its second FCPR vehicle, ISAI Expansion, on €30m.

FIG launches VC fund for graduates

London-based venture capital firm Find Invest Grow (FIG) has launched its maiden vehicle, the FIG Concept Seed Fund.

Advent exits Vitrue to Oracle

Advent Venture Partners has exited US portfolio company Vitrue in a trade sale to IT solutions developer Oracle, following a 15-month holding period.

EDF sponsors new cleantech VC fund

French energy company EDF has partnered with private equity house Idinvest Partners to launch cleantech venture capital fund Electranova Capital.

Governments' contribution to VC up six-fold

Government agencies and corporates are increasingly active in venture – but they should push further in support of European VC, argues Olivier Marty

Caixa Capital Risc raises third fund

Caixa Capital Risc has raised its third fund, according to reports in the Spanish press.

Connect Ventures holds €16m first close

Newcomer Connect Ventures has held a тЌ16m first close for its maiden early-stage fund.

Innovacom seed fund Technocom 2 closes on €30m

Seed fund Technocom 2 has held a final close on €30m, after receiving a €18.7m commitment from Fonds National d'Amorçage (FNA).

Notion Capital holds a $100m first close

Notion Capital has announced a $100m first close for Notion Capital Fund 2, its second fund focused on emerging cloud computing and software-as-a-service (SaaS) companies in the UK and Europe.

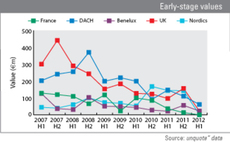

Declining activity belies venture successes

Although European venture capital activity decreased by 12% to €974m last year, 2011 saw a number of sizeable fund closes as well strong exits, indicating fresh appetite for the asset class.

Earlybird closes fourth fund on $100m

Earlybird Venture Capital has held the first close of its fourth venture fund on $100m.

Avindia Capital launches energy fund

Spanish private equity firm Avindia Capital has announced the launch of its first fund, Avindia Energy I.

Index Ventures closes life sciences fund at €150m

Index Ventures has closed its latest life sciences fund, raising тЌ150m from LPs and pharmaceutical companies.