Sector

Lonsdale buys infrastructure consultancy Infrata

Deal for London-based firm marks the second investment made outside the GPтs buyout fund, which closed investment period last year

GBL bags second healthcare asset this week with SBO of Sanoptis

Vendor Telemos to fully exit DACH eye clinics operator following auction that also saw ICG and Ares compete for the asset

KKR makes USD 15bn approach for Ramsay Health Care

European operations of Australia-listed hospital group account for EUR 760m EBITDA

Bowmark buys workflow automation provider WSD

GP will seek to expand London-based companyтs product development and grow in North America, Europe and Asia

Main sells Obi4wan to PE-backed Spotler

Exit to CNBB portfolio company Spotler Group ends a holding period of almost six years

GBL acquires Affidea from B-Flexion

Formerly known as Waypoint, vendor is fulling exiting the pan-European outpatient group; new owner will invest EUR 1bn in equity

Investindustrial sells Neolith to CVC VIII

During Investindustrial tenure Neolith posted EUR 145m in revenues in 2021 and an EBITDA CAGR of approximately 20%

Buyout groups circle Trivium Packaging auction

Owners OTPP and Ardagh requested non-binding offers last week after distributing sale materials in March

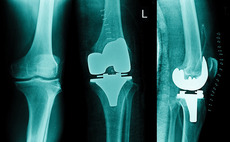

EQT pauses LimaCorporate auction

Sponsor is expected to reassess options for the Italian orthopaedic prosthetics producer after new CEO appointment

Tilt Capital holds first close for debut energy transition fund

Co-founder Nicolas Piau speaks to Unquote about the GP's Siparex partnership. fundraise and strategy

IK Partners sells Recocash to Qualium Investissement

Deal marks the third exit from IK Small Cap II, which is at least 93% deployed

LGT's Batisanté draws interest from multiple sponsors in hotly contested sale

GPs including Chequers, Equistone, IK, Latour and Naxicap are circling the LGT-backed firm

ICG, Ares and GBL among sponsors in Sanoptis second round

Current backer Telemos wants to remain invested as a minority shareholder in the ophthalmology group

EMZ exits Ankerkraut to Nestlé for 2x money

Deal marks the first full exit for EMZ Fund 9 and ends a holding period of less than two years

Convent Capital holds first close for Agri Food Growth Fund

Growth capital vehicle will invest EUR 5m-EUR 20m per deal and has made its first investment

Getir backer Re-Pie launches EUR 70m VC fund

Re-Pie Ventures 1 plans to hold a first close by the end of 2022, general partner Mehmet Ali Ergin said

Capital Croissance gears up for Smart AdServer exit

GP bought a majority stake in the France-based digital advertising platform from Cathay in 2021

Parcom prepares insurance provider TAF for exit

Parcom acquired a majority stake in the Netherlands-based business in December 2018

Briar Chemicals owner Aurelius launches sale process

Aurelius had previously gauged interest for the chemicals producer in 2019, Mergermarket reported

Carlyle acquires life sciences investor Abingworth

Deal follows EQT's acquisition of LSP in November 2021 as asset managers look for greater specialisation

Inovexus gears up for seed investments in AI, blockchain, metaverse startups

Evergreen fund's LPs include Crédit Agricole, according to Inovexus CEO and founder Philippe Roche

Advent buys IRCA in SBO from Carlyle

Bakery ingredients firm has a reported EV of EUR 1bn and is expected to post 2022 EBITDA of EUR 75m

Silverfleet exits Prefere Resins in SBO to One Rock

Concerns about Russian exposure and raw materials costs surfaced in the sale process, Mergermarket reported

EMZ acquires FotoFinder Systems

EMZ is acquiring a majority stake in the medical imaging company via EMZ 9, which is 80% deployed