Fundraising

EU FSR could impact PE fundraising with potential rise in 'clean funds'

FSR could lead GPs to create funds without foreign LPs; red tape around sovereign wealth funds likely

VC Profile: Possible Ventures lines up frontier tech deals halfway through fresh EUR 60m fundraise

Germany-based pre-seed investor is set to hold a first close for its third fund in mid-September

Hayfin exceeds EUR 6bn target for fourth direct lending fund

Firm expects to raise EUR 7bn by year-end as it gears up to meet growing private credit demand in Europe

Eurazeo co-CEOs seek to reassure market following key departures

Listed GP is also considering options for its stake in Spanish PE platform MCH, it said in its latest results

Thematic funds are PEs' secret weapon for times of change, volatility – PE Forum Italy

Betting on secular trebds and corporate partnerships, GPs are finding ways to deploy in a challenging market

Unquote Private Equity Podcast: PE perspectives from Berlin

Unquoteтs Min Ho and Rachel Lewis digest the key takeaways from this yearтs SupeReturn

EU Foreign Subsidies rules hold specific challenges for PE

Sovereign wealth funds and pension funds commitments may trigger EC attention under new EU foreign subsidies regulation

Astorg cuts flagship fundraising target with EUR 4bn raised

French GP initially expected to raise around EUR 6.5bn for eighth flagship fund, Unquote previously reported

European LPs bullish on 2024 PE fund vintages – Coller Capital

LPs remain positive on PE but are considering increasing infra and private credit allocations, latest survey shows

Just Climate holds final close for debut USD 1.5bn fund

GP will take minority stakes in industrial businesses targeting climate challenges, focusing on greenhouse gas reduction

LP Profile: Lennertz & Co gears up for new tech impact venture fund-of-funds

German family office’s new strategy is set to launch this year with a EUR 50m-EUR 100m target

Women in PE: Innova Capital's Pasecka on consolidation and succession opportunities amid macro challenges

Magdalena Pasecka discusses the Polish GP’s fundraising and deployment plans, as well as advice for emerging leaders in the industry

European VCs need to match actions to words by increasing funding to female-led companies

Women-led startups usually receive less than 2% of VC capital, but more diverse, defensible female-founded businesses emerging

GP Profile: Investindustrial eyes near-shoring opportunities as third growth fund closes

GP closed its latest fund within a 12-month period on the road with strong support from European LPs

Eurazeo halves deployment and PE fundraising in Q1 amid 'complex and uncertain' environment

GP has EUR 7.7bn dry powder across its strategies and remains assured of its potential to make exits in H2 2023

Unquote Private Equity Podcast: Taking the plunge - GPs dive into alternative pools of capital

The Unquote team is joined by Thomas EskebУІk, CEO of private markets platform Titanbay, to discuss private marketsт search for alternative sources of commitments

EQT launches semi-liquid strategy for individual investors

Strategy will focus on PE and infrastructure and will be led by ex-Partners Group exec William Vettorato

Cerea Partners raises EUR 700m-plus for multi-asset food and beverage funds

France-headquartered GP is on the road for vehicles across its private equity, mezzanine and senior debt strategies

Wise Equity closes sixth fund on EUR 400m, eyes Italian family-owned B2B targets

Italian GP reached its hard-cap, raising its biggest fund to date four months after launching

GP Profile: Ardian Expansion doubles down on generalist approach, eyes EUR 3bn Q2 fundraise launch

With its current EUR 1.5bn fifth fund almost at full deployment, Ardianтs Expansion strategy expects to benefit from LP appetite for its strategy ahead of EUR 3bn fundraise

GP Profile: Opera Investment Partners doubles fund size with EUR 200m target for next vehicle

Fund I тalmost fully committedт with one exit completed and two-three more realisations expected in the next 18 months

Podcast: Q1 2023 - Bank runs, fund home runs and markets come undone

Unquoteтs reporting team discuss themes that have arisen in Q1 2023, ranging from liquidity management to venture and growth activity

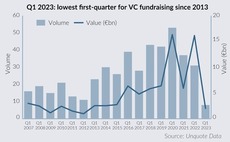

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

Half of LPs allocating to impact from generalist pool as market matures – Rede Partners

Jeremy Smith and Kristina Widegren speak to Unquote about key takeaways from the private capital adviserтs Private Markets Sustainability and Impact Report