Search results

Displaying Results 21-30 of 2148 for "how to spend it"

Netzkontor sponsor DBAG weighs exit options following beauty pageant

Netzkontor’s backer DBAG is in the early stages of exploring exit options for the German telecoms service provider, three sources familiar with the situation told Mergermarket.

It's a new generation: Emerging PE professionals are propelling their careers with ESG – PE Forum Italy

The next generation of private equity (PE) professionals is uniquely positioned to build a different dialogue with young management teams and to make ESG considerations a significant component of how deals are struck and investments managed, delegates told Mergermarket’s Private Equity Forum Italy 2023.

Women in PE: Abris Capital Partners' Nachyla on newly launched fundraise and portfolio priorities amid geopolitical challenges

Faced with continuing geopolitical challenges, Central Europe-based Abris Capital Partners is prioritizing fundraising, core sector market consolidation, and ESG efforts in its portfolio, partner Monika Nachyla told Unquote.

Thematic funds are PEs' secret weapon for times of change, volatility – PE Forum Italy

Private equity (PE) executives are thinking hard about sector competences as they bring in operating partners to help them launch thematic funds around growth sectors, delegates told Mergermarket’s Private Equity Forum Italy 2023.

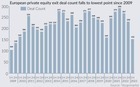

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Secondary buyouts (SBOs) in the European market have fallen to their lowest level since 2H09, with sponsors reluctant to play pass-the-parcel with assets amid tough financing markets and increased deployment selectivity,Т MergermarketТ data shows.

AlphaPet Ventures gears up to collect first-round bids as investors weigh up pet food's appeal

The sale process for Germany’s AlphaPet Ventures, a capiton- and VC-backed pet-food brand platform, has kicked off, three sources familiar with the situation said.

SGT Capital focuses on co-investments and LP diversification in next stretch of USD 2bn fundraise

Mid-market sponsor SGT Capital is focusing on its co-investment pitch and LP geographical diversification, in a shift from its initial fundraising approach as it aims to reach the USD 1.5bn target for its second private equity fund, co-managing partner Joseph Pacini told Unquote.

HLD's 52 Entertainment sale on hold over valuation issues

The sale of French gaming expert 52 Entertainment has been put on ice, two sources familiar with the matter told Unquote sister publication Mergermarket.

TSG's Bergfreunde hits the market in JPMorgan-led auction

TSG Consumer-backed outdoor gear specialist Backcountry is selling Bergfreunde with JPMorgan guiding an auction process, three sources familiar with the situation said.

Frst aims to hit EUR 100m hard cap by year-end for AI-focused third fund

French venture capital (VC) firm Frst has held a EUR 72m first close for Frst 3, which will focus on early-stage artificial intelligence-based (AI) startups and aims to raise EUR 80m-EUR 100m in total, co-founder and partner Pierre Entremont told this news service.