European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

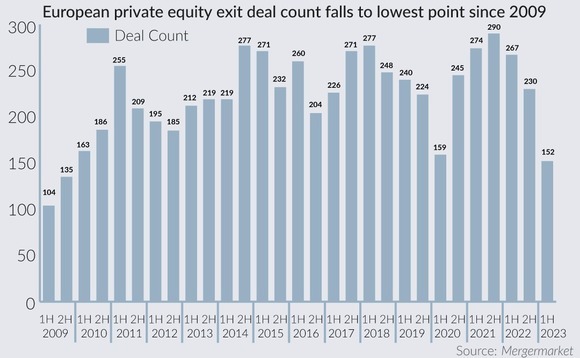

Secondary buyouts (SBOs) in the European market have fallen to their lowest level since 2H09, with sponsors reluctant to play pass-the-parcel with assets amid tough financing markets and increased deployment selectivity,Т MergermarketТ data shows.

Faced with uncertainty around transaction execution risk, sponsors have been reluctant to bring assets to market in recent months, with just 41 SBOs announced in 1H23. These same conditions have caused the number of exits to fall even lower than the 10-year low-point reached in 2H22, and the lowest since the start of the COVID-19 pandemic.

While trade sales accounted for 73% of exit activity in 1H23, these also reached their lowest point since 1H20.

This low level of exit activity will be concerning for many sponsors, given that realisations are vital in providing both liquidity and vindication for limited partners (LPs) to commit to current or upcoming fundraises. Sponsors are also less likely to be able to pass on proceeds of refinancings to their LPs to make returns, narrowing their options to bridge the exit impasse.

Many sponsors have seen their value creation and exit plans elongated by the steep rise in the cost of capital, leading them to reassess whether they need to make exits. "If you are sitting on an asset that is running nicely, why would you sell it?" argued Steve Roberts, PE Leader for Germany and EMEA at PwC. "As a seller, PEs will know whether the PE buyers' universe will be there for a deal." Exit windows can be flexible to some extent, Roberts added, noting that many sponsors will be waiting to see when the financing market will be coming back before running up the costs associated with reviewing a deal.

Large-cap woes

Some large-cap exits have got over the line in the last three months, accounting for the 71% uptick in disclosed deal volume between 1Q23 and 2Q23. These included EQT's [STO:EQT] sale of Denmark-based validation solutions business Ellab to Novo Holdings, which reportedly valued the business at EUR 1bn.

However, such deals are the exception, as the buyer seller valuation gap persists. The postponed sale of HLD-backed French gaming developer 52 Entertainment and the ongoing sale of BC Partners-backed VetPartners are both cases in point, with first round bids for the latter coming in below the desired numbers, as reported.

Some sponsors have been looking to minimise financing issues and their resulting execution risk by refinancing their portfolio companies ahead of a sale. Partners Group is expected to secure a GBP 1bn-plus portable refinancing for UK-based software and technology outsourcing firm Civica ahead of a potential exit, Mergermarket sister publication Debtwire reported in June.

While market participants that spoke to this news service were hesitant in suggesting a potential timeline for adjustment, much hope is being pinned on 2024, as well as alternative exit routes.

Continuation fund capacity

Although realisation pressure is bound to spur GPs to bring assets to market through M&A, continuation funds (also known as GP-led secondaries) remain a viable ‘fourth option' beyond an SBO, trade sale or IPO. While these vehicles mark an exit at fund level, they also typically extend a sponsor's holding period by up to five years, allowing them to wait out the current uncertainty in hope of more favourable conditions.

Continuation vehicles are not a simple catch-all solution for hard-to-exit assets, however. "To form a successful continuation fund, the GP would need to satisfy existing LPs that an exit to the continuation fund will deliver a strong return for the selling fund, consistent with or exceeding the GP's base case scenario when they initially made the investment," said Nigel van Zyl, partner and co-head of the private funds group at Proskauer Rose.

The GP would then need to present a business case to the potential new investors that there continues to be a material opportunity in the asset, alongside confidence that the GP and the company's management team are best placed to deliver this growth if afforded additional time and capital, he said. "Some large healthcare and technology assets in particular have grown incredibly over their lifecycles and are still performing strongly," he noted.

Sponsors have been taking advantage of the growing prevalence of GP-led secondary deals to move assets of various sizes to continuation funds. These deals include Maguar Capital-backed HR software platform HRworks, which marked the emerging small-cap technology sponsor's first exit, as reported. Larger sponsors are also turning to the secondaries market, with Triton recently raising EUR 1.63bn for a multi-asset vehicle for four assets previously held in its 2012-vintage fourth fund, and Charterhouse raising a continuation fund to house Belgian pharmaceutical business Serb.

Transaction volumes across the secondaries market might be constrained by limited buyside capacity, however, noted fellow Proskauer Rose partner Warren Allan. "We have seen strong deployment but relatively limited fundraising, resulting in an undercapitalised market that could restrict volume growth."

Secondaries fundraising in 1H23 totalled EUR 22.2bn across four vehicles, according to Unquote Data. However, the vast majority of this was taken up by Blackstone's USD 22.2bn (ca. EUR 18.4bn) ninth Strategic Opportunities vehicle, reflecting the success of a singular fundraise as opposed to a plethora of secondaries GPs coming to market.

Although there are widespread concerns about whether buyside capital can keep up with sellside requirements, there is hope for further fundraising prospects. "We are seeing some non-traditional buyers hiring specialist teams to invest in GP-led transactions, and some asset managers are raising capital from high-net-worth investors to access the private markets through secondaries transactions," Allen noted.

Generalist buyers hiring secondaries expertise include France-headquartered sponsor Astorg, while secondaries firms that have turned to the high-net-worth universe include Coller Capital, as reported.

Secondaries veterans are also expected to raise further capital in the coming months, with asset managers Partners Group and Unigestion registering new funds in recent months, according to Unquote Data. Recently deployed co-mingled LP and GP strategies are also likely to be overweight in LP stakes, having taken advantage of plentiful dealflow and appealing discounts in this space in 1H23; in rebalancing their portfolios, these funds could also present potential buyers for GP-leds.

The right businesses?

Although overall exit activity has been on a downward trajectory since 3Q 2021, aside from a slight uptick in Q2 2022, some might take comfort in the fact that exit deal count plateaued in 2Q23 versus 1Q23, putting a halt to the downward momentum.

Many market participants have spoken of their hope for an uptick in M&A in 2H23, as signalled by the slight increase in private equity activity by both volume and deal count between 1Q and 2Q this year.

Sentiment is changing quickly, according to market practitioners who spoke to Mergermarket. "In the past few weeks we have started to see a shift," said the head of M&A at a boutique advisory firm. "There are more bidders in processes now than there were at the beginning of the year, for the right businesses."

In spite of continuing inflationary pressures, several companies in the consumer and retail sector are high priority exit candidates, according to Mergermarket's Likely to Exit (LTE) algorithm.* The most hotly tipped exit candidates in the European market include god food business Butternut Box, which is backed by L Catterton and has an LTE score of 87. Cerelia, a France-based ready-to-use dough producer backed by Ardian, is another top exit candidate, with an LTE score of 83.

Some sponsors with assets in this sector are being encouraged to shift their original exit plans, including Permira, which is being courted by advisers regarding a potential stake sale for luxury clothing retailer Golden Goose, as opposed to its original IPO plan, as reported.

Business services companies, and particularly those at the intersection of this sector and technology, are consistently proving to be popular exit candidates. Ongoing processes in the sector including ICG-backed financial data platform With Intelligence and Montagu-backed aviation data specialist Janes have piqued sponsors' interest, as reported.

Although many companies are ripe for an exit, vendor due diligence will be crucial in convincing cautious sponsors to pick up their pens and engage in SBOs. "More work is being put into the preparation of due diligence and we're even making more effort to visualise the data better in the documents as a sellside tool, to really help bidders understand what they're buying," said the head of M&A at a boutique bank. "It depends on the business, but it better showcases things like ARR, ARR bridges, retention rates, and net retention."

"It's not just about margins," said PwC's Roberts, noting that advisers now need to spend time explaining how certain macroeconomic issues have been dealt with. "Inflation is the number one topic, aside from digitalisation and ESG," he said.

*Mergermarket's LTE predictive analytics assign a score to sponsor-backed companies to help track and predict when an exit could occur through M&A, an IPO, a direct listing or a deSPAC transaction.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds