Aberdeen Standard Investments

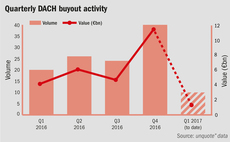

Quiet start to 2017 for DACH buyouts following Q4 flurry

Number of large German deals saw the DACH region outpace its European neighbours at the end of 2016, in terms of aggregate value

Q4 Barometer: Large-cap deals boost value in a shrinking market

Spike in megadeals boosted aggregate deal value in Q4, though volume was down 20% year-on-year

SL Capital hits £516m final close for maiden infrastructure fund

Fund launched in June 2014 with a ТЃ400m target and already has four portfolio companies

SL Capital trust goes global, lowers size remit

Strategy changes proposed for the Standard Life vehicle have been approved by shareholders

SL Capital holds $213m first close for third secondaries fund

UK GP targets $400m for its secondaries vehicle focused on small-cap and mid-market funds

Q3 Barometer: Core mid-market buyouts return to growth

Mid-market deal volume across Europe reached its highest total in five quarters

Equistone, SL Capital exit Together in £288m deal

Management buy-back deal for the specialist lender follows a 10-year holding period

Q2 Barometer: European buyout activity rebounds

European deal volume reached its highest total in six quarters, while aggregate value increased by 80% compared to Q1 levels

Abundant dry powder fires secondaries prices sky high

This second installment of our secondaries focus takes an in-depth look at pricing trends

Q1 Barometer: Slow start across Europe despite French uptick

The European buyout segment witnessed a slow Q1 volume-wise, with the number of deals recorded being the lowest total since Q1 2014

Strong valuations in Nordic region driving co-investments

With strong pricing in the Nordic countries, GPs are looking to co-invest in order to secure deals

Q4 Barometer: Record value in 2015 despite end-of-year dip

Fewer deals but higher aggregate value in 2015 meant the average deal value jumped by a whopping 53%

Still no turnaround fund in sight for Nordic market

Could 2016 see the arrival of Nordic turnaround funds given continued LP demand for the strategy?

Boomerang buyouts: returning to old assets

A string of recent deals have seen GPs returning to former assets; is this a safe strategy?

SL Capital Partners hires John Seal

John Seal joins SL Capital as head of junior debt team

Germany: Generational shift the answer to cultural conundrum

As dealflow in Germany remains subdued, could a new generation bring about change?

Family office perspective: turning away from traditional PE

A two-part, in-depth look at what family offices think of private equity

Q1 Barometer: deal volume and value decline

The European buyout market witnessed a fall in both deal volume and value for Q1

SL Capital's Gunn wants to see Nordic turnaround funds

SL Capital's Gunn on the intricacies of the Nordic markets

Germany, UK drove 10% activity uptick in Q4 2014

Fourth quarter witnessed an encouraging rise in deal volume and value

Herkules holds NOK 2.5bn final close

Close is less than half of reported NOK 6bn target

SL Capital hires two

Kellermann becomes new head of DACH

Q3 Barometer: Mid-market proves resilient

Overall European buyout activity declined, but Q3 figures highlight mid-market's resilience

Branching out – LPs warn of potential pitfalls

GPs should carefully consider their strategy for diversifying, or risk alienating LPs