Investments

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater

BHM Group builds on PE strategy, eyes European medtech and renewable energy acquisitions

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Trind VC plans up to five early-stage investments in next six months

VC has deployed around 10% of its second, EUR 55m fund and plans to invest in up to 40 startups

Credo Ventures sees activity uptick, plans further deals in 2023 with EUR 75m fourth fund

Czech VC firm's latest vehicle is around 50% deployed and expects to make 25-30 deals in total

CMA scrutiny of high-leverage PE divestment purchases expected to increase

PE could stand to lose its historic advantage with heightened regulatory baggage

Evoco expects portfolio acquisitions, assesses potential exits in 2H23

Switzerland-headquartered GP is currently deploying equity via its EUR 162m Evoco TSE III fund

GP Profile: Apheon builds on family roots, mulls exits and reinvestment opportunities

Belgian GP, formerly known as Ergon, to continue to target family- and entrepreneur-owned European businesses

Turning the tables – an M&A downturn means investment banks are now targets themselves

Some dealmakers with healthy balance sheets and willingness to go countercyclical are pursing acquisitions

Mediterra Capital marks inaugural exit from second fund with Paycore sale

Turkish GP's EUR 166m Fund II held a final close in 2018 and holds eight investments

AnaCap in advanced talks for two deals; has 'exciting' financial services and tech pipeline

Financial services-focused sponsor is honing in on one majority and one minority stake deal

Turkven exits MNG Kargo, expects partial exit from Mikro Yazilim

Turkish GP sold its majority stake in Turkish parcel delivery business and could make a second exit to PE-backed TeamSystem

Eurazeo co-CEOs seek to reassure market following key departures

Listed GP is also considering options for its stake in Spanish PE platform MCH, it said in its latest results

Active Capital in EUR 150m fundraise; SIF strategy and portfolio companies eye buys

Industrials-focused sponsor expects reshoring trend to generate uptick in opportunities

Bridgepoint extends Europe VII fundraising timeline to tap 2024 allocations

GP has raised EUR 6bn against its EUR 7bn target but has seen a 67% year-on-year drop in investment income due to fall in exits

Women in PE: Abris Capital Partners' Nachyla on newly launched fundraise and portfolio priorities amid geopolitical challenges

Partner Monika Nachyla outlines the CEE-based GP's fundraising and portfolio development plans

Ayre Group's VC arm eyes 10-15 blockchain deals this year

Family office-backed firm plans to invest at seed and Series A with tickets of USD 2m-USD 3m

Thematic funds are PEs' secret weapon for times of change, volatility – PE Forum Italy

Betting on secular trebds and corporate partnerships, GPs are finding ways to deploy in a challenging market

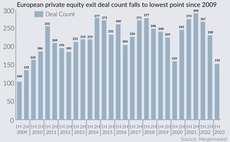

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

Capza sees solid demand for Flex Equity strategy as fifth fund reaches two-thirds deployment

GP is seeking bolt-ons for French consulting firm Neo2 following fresh minority investment, partner Fabien Bernez said

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve OтHare about the GPтs approach to its recent realisations

PE purchases stall in Italy as buyers lose faith – PE Forum Italy

PE players are hoping that valuation expectations will align in 2H 2023, easing dealmaking backlog

Portable refis pave way for smoother sponsor exits in rocky market

Sellers are aiming to bolster buyer confidence, securing debt that can be transferred to the next LBO

GP Profile: NB Renaissance outlines acquisition and exit plans in final stretch of current fund deployment

Nearing full deployment for its third fund, Italian private equity firm is prepping one more deal and at least one exit by year-end

Dutch sponsor Egeria gears up for new fund launch next year

GP’s 2017-vintage, EUR 800m current fund is expected to be fully deployed within 12-18 months