Astorg Partners

Astorg inks first US deal with Anaqua

GP uses Astorg VII, closed last month on €4bn, to acquire a stake in software developer Anaqua

GP Profile: Astorg

Managing partner Thierry Timsit discusses investment strategy, competition, ESG and political instability

Astorg holds €4bn final close for seventh fund

Three months after launch, Astorg's seventh fund exceeds €3.2bn target and nears hard-cap

Astorg's M7 buys division of Liberty Global's TV operations

Luxembourg-based M7 Group bolts on eastern European TV operations of Liberty Global

French PE investment in aerospace soars to new heights

Asset class is fuelling growth in the industry, with aggregate value in France picking up pace in recent years

Astorg buys Aries Alliance in SBO

Phoenix, CM-CIC Investissement, BNP Paribas Développement and Ace Management exit the business

Montagu sells Nemera to Astorg in €1bn deal

Nemera is valued at more than €1bn and will post a 2018 EBITDA of €70m, say reports

Partners Group buys Megadyne in SBO

Company's founders, the Tadolini family, reinvested in the business alongside Partners Group

Astorg buys IGM Resins from Arsenal Capital Partners

French GP acquires the Dutch ultraviolet curable materials manufacturer in a secondary buyout

Astorg to sell Metrologic to trade

French 3D measurement specialist Metrologic to be sold to Swedish Sandvik in €360m deal

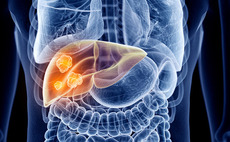

Cathay and OrbiMed divest Echosens to Astorg

Deal is the first exit for Cathay's 2014-vintage €500m Sino-European MidCap fund

Astorg's Parkeon to bolt on Cale

French parking services provider Parkeon starts talks to acquire Sweden-based Cale

Astorg, Montagu fully exit Sebia

CVC Strategic Opportunities and the Bettencourt-Meyers family office join CDPQ as shareholders

Astorg, Montagu partially exit Sebia to CDPQ

Astorg and Montagu acquired the healthcare company from Cinven in 2014

Astorg acquires Surfaces Technological Abrasives

Previous investor Xenon Private Equity acquired its majority stake in the company in 2015

Deal in Focus: Epiris sells Audiotonix to Astorg

Sale of the audio mixing console business will generate a return of 4.8x and IRR of 51% for the vendor

PAI-backed Ethypharm acquires Martindale Pharma

New combined entity will generate revenues in excess of тЌ300m

Deal in Focus: Astorg sells Kerneos to Imerys for €880m

Sale of the specialised chemicals company follows a three-year holding period in which the group invested in new ventures and made bolt-ons

Astorg sells Kerneos to Imerys for €880m

Entreprise value represents an 8.8x EBITDA multiple and is expected to close in summer 2017

Astorg sells Metalor to Japanese buyer

Exit comes two weeks after Astorg closed its sixth buyout fund on €2.1bn

Astorg closes Astorg VI fund on €2.1bn extended hard-cap

GP's fourth fund closes above original €1.5bn target and €2bn hard-cap

Deal in Focus: Astorg sells Ethypharm after nine-year holding

Resisting regular suitors, the GP's nine-year tenure of the pharmaceutical company allowed it to fully implement a long-term acquisitive strategy

PAI in €725m deal to acquire Ethypharm from Astorg

Deal comes nine years after Astorg acquired a 60% stake in the company via the Astorg IV fund

Astorg acquires Parkeon in €450m deal, nears close on 6th fund

Astorg's sixth buyout fund is expected to close on its €2.1bn hard-cap in May