Expansion

Blackstone takes minority stake in Groupe Premium

Deal values French wealth manager at EUR 1.15bn after earlier full exit attempt saw Eurazeo target EUR 1.5bn

e-Attestations aims to triple size with new Keensight backing

Keensight is investing in the risk management platform via its EUR 1bn fifth fund, which closed in 2019

The Bolt-Ons Digest - 3 July 2023

Unquoteтs selection of the latest add-ons with Palatine's Anthesis, Nordic Capital's Regnology, Waterland's Janssen and more

GP Profile: Limerston Capital anticipates higher volume but more complex M&A as market steadies

UK-based GP is seeing dealflow driven by carve-outs and buy-and-build in a market where organic multiple arbitrage is no longer a given

The Bolt-Ons Digest - 26 May 2023

Unquoteтs selection of the latest add-ons with H&F's TeamSystem, Nordic Capital's Regnology, 3'i's Dutch Bakery and more

Baird Capital invests in Freemarket

GPтs growth capital investment in UK-based fintech platform marks seventh deal from Fund II

BGF makes GBP 19m minority investment in Brompton Bicycle

Transaction marks London-based foldable bike manufacturerтs first capital raise to accelerate international growth

The Bolt-Ons Digest – 17 April 2023

Unquoteтs selection of the latest add-ons with Triton's BFC Group, Seven2's Groupe Crystal, Palatine's FourNet and more

EQT Growth in active deployment with EUR 100m IntegrityNext deal

Sponsor to support organic growth of Munich-based ESG software group via inhouse digital and sustainability teams

The Bolt-Ons Digest – 20 March 2023

Unquote’s selection of the latest add-ons with Cinven's ETC, PAI's Apleona, TA Associate's Fairstone, and more

The Bolt-Ons Digest – 21 February 2023

Unquote’s selection of the latest add-ons with Investindustrial's CEME, Astorg's Fastmarkets, H&F's TeamSystem, and more

Getir plans new funding round for H1 2023

Fast grocery delivery group could fetch a valuation above the USD 10bn-plus of its last round

The Bolt-Ons Digest – 26 January 2023

Unquoteтs selection of the latest add-ons, with ICG's Circet, Five Arrows' Mintec, Carlyle's Jagex, and more

German health minister's 'locust sponsors' comments spook live healthcare deals

New entrants scared by remarks on limiting profits; existing investors expected to rush to complete bolt-ons

The Bolt-Ons Digest – 14 December 2022

Unquoteтs selection of the latest add-ons, including CVC's Stark Group, Bridgepoint's Kereis, EQT's Open Systems, and more

Highland Europe leads EUR 60m round for Le Collectionist

France-based luxury holiday company is aiming for market consolidation following the fresh funding

The Bolt-Ons Digest – 11 November 2022

Unquote’s selection of the latest add-ons including Hg and ICG's Iris, Inflexion's THE, Bain's House of HR and more

The Bolt-Ons Digest – 17 October 2022

Unquoteтs selection of the latest add-ons with Equistone's Ligentia, Bridgepoint's Infinigate, Ambientaтs Namirial and more

Advent to merge Caldic with Wilbur-Ellis' Connell

Focused on nutrition, pharma, and industrial formulations, group aims to expand in APAC, LatAm

MCF Corporate Finance buys Cubus in debt advisory expansion

Deal with Frankfurt-based firm follows demand for combined M&A and financing services

Holland exits Mauritskliniek in sale to PE-backed Corius

Sale of Dutch dermatology group comes nine months after regulator blocked sale to Triton's Bergman

Verdane invests in Qbtech, Topro via impact fund

Privately-owned ADHD test maker and PE-backed mobility device producer are fourth and fifth deals from Verdane Idun I

FPE Capital invests in Global App Testing

UK-based testing platform marks the third investment of the GPтs GBP 185m third fund

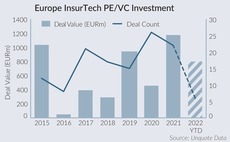

Sidekick spinoffs: Insurtech scale-ups attract PE interest

Investment set to break EUR 1.1bn mark this year as sponsors seek for rising stars