Bain Capital

Hellman & Friedman buys TeamSystem from HgCapital et al.

HgCapital bought the company for €565m in 2010

Southern Europe eyes new year with caution after mixed 2015

unquote" looks back on PE activity witnessed in southern Europe in 2015 to predict trends for 2016

Permira sells Pharmaq to Zoetis for $765m

Exit comes just two years after Permira bought Pharmaq for тЌ250m

PE-backed WorldPay lists in largest London IPO of 2015

Flotation values payment technology business at ТЃ4.8bn

Bain in exclusive talks for TowerBrook's Autodis

PE-backed buyout would be fourth seen by business since inception

Bain to float Ibstock less than year after buyout

GP will offload part of stake in brick maker

Level 20 aims to boost gender diversity in PE

New organisation will run a mentoring programme and formal networks

PE-backed WorldPay to list in October

Payments company intends to raise cТЃ900m

Bain picks up CRH divisions for £414m

Two divisions sold to Bain comprise CRH's clay companies Ibstock in the UK and Glen Gery in the US

Bain merges Brakes' fresh food brands with Fresh Direct

M&J Seafood, Pauleys and Wild Harvest to be merged into new company

Bain, Apax bid for Portugal Telecom

Bid is higher than that made by Altice

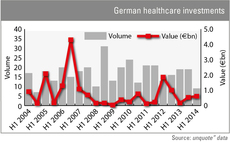

German healthcare deals on the decline

Healthcare deals in Germany have dipped, highlighting difficulties in the space

Bain Capital raises €2bn towards new Europe fund

Vehicle targeting €2.5bn

Bain nets €160m in IMCD flotation

Net proceeds from the IPO reached €462m

Bain's IMCD sets IPO price range

Bain retains significant shareholding post-IPO

CVC's Cerved targets €1.3bn valuation at IPO

Company to use proceeds to pay down debt

Kirkland & Ellis Asia PE head to relocate to London

David Eich to bolster firm's corporate relationships in Europe

Bain's IMCD aims to raise up to €500m in IPO

Bain to sell shares in offering

Deal in focus: ATP, Advent and Bain pay €2.3bn for Nets

US GPs buy Scandinavia's largest card payment company

Advent, ATP and Bain to acquire Nets

Trio buy 100% of Nets for DKK 17bn

France struggles to play down SBO typecast

Early signs however hint at primary revival in 2014

Italian GPs cash in as valuation gap narrows

Last year was challenging for Italian private equity; fundraising remained low and exits were few and far between – though stuttering deal volume was punctuated by a handful of large buyouts, boosting deal value. But it wasn’t all bad. Amy King reports...

PE still in race for Rexam healthcare unit

Medical supply maker Gerresheimer has dropped out of the bidding process for Rexam's healthcare unit, while private equity firms such as Bain and KKR are still in the race, according to local reports.

Deal in focus: Risk Capital buys Neilson from Thomas Cook

Risk Capital Partners' acquisition of Neilson Active Holidays from embattled holiday-operator Thomas Cook is a rare example of private equity being invited in.