Coller Capital

Fundraising gets personal

Fundraising gets personal

Top 5 final closes of 2012 so far

Fundraising

Lloyds sells £1bn private equity portfolio to Coller

Lloyds Banking Group has agreed to sell a portfolio of private equity investments worth ТЃ1.05bn to Coller Capital.

Coller's sixth fund hits $5.5bn final close

Coller Capital has held a final close for its sixth fund on $5.5bn, exceeding its original $5bn target.

Palamon appoints Michael Beetz as associate principal

Palamon Capital Partners has appointed ex-Coller associate Michael Beetz to join the firm as associate principal.

LPs demand greater transparency from GPs

LPs are demanding more transparency from GPs and more support from governments to exhaust the full potential of private equity, according to Coller Capital's Global Private Equity Barometer.

LPs getting to grips with private equity's bad reputation

PE's image issue

European secondaries boom unlikely to end soon

Secondaries boom unlikely to end soon

Interview: Omnes Capital's Fabien Prévost

GP Interview: Fabien Prévost

Lack of distributions continues to fuel secondaries

Exit woes fuel secondaries

Crédit Agricole PE becomes Omnes Capital

Coller Capital has finalised the acquisition of Crédit Agricole Private Equity (CAPE), which has been renamed Omnes Capital.

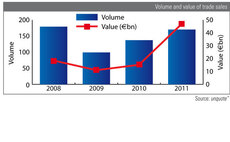

Trade sale values boom in 2011

Trade sales continue to be the most common exit route in 2011 and increased by almost €30bn in value, while secondary buyouts are stalling, reflecting the tough economic conditions of the past year. Anneken Tappe reports

2011 exits: trade sales almost triple in value

As the graph shows, the proportion of trade sales, the most common exit route, has not changed significantly between 2010 and 2011.

Coller buys Crédit Agricole PE unit and funds

Coller Capital has agreed to acquire fund manager Crédit Agricole Private Equity (CAPE) from Crédit Agricole, as well as the bank's interests in the funds it manages.

One in five LPs to cut GP relationships

One in five European LPs expect to cut the number of GPs they invest with over the next two years, according to Coller Capitalтs Global Private Equity Barometer.

Coller to buy €500m secondaries portfolio from Crédit Agricole

Coller Capital is in talks with Crédit Agricole to buy €500m worth of stakes in buyout funds, according to media reports.

Secondaries players to fill later-stage gap

A lack of LP appetite has left a void at the later-stage end of the European venture market. Could secondaries players hold the key, asks Emanuel Eftimiu