Croatia

A&M Capital Europe buys Pet Network for EUR 260m

Pet Network was created by TRG in 2018 through the acquisition and merger of three businesses

Enterprise Investors buys remaining stake in Pan-Pek

GP has acquired the remaining 35% in the company, having bought a 65% stake in the company in May 2018

Mezzanine Management sells Optimapharm to Rohatyn Group

Mezzanine Management provided a €10m mezzanine facility to the business in October 2018

BC- and KKR-backed United Group bolts on Tele2 Croatia

Deal is the Dutch telecommunications group's first acquisition under BC's tenure

Mid Europa buys Mlinar

GP is currently investing from Mid Europa V, which held a final close on €500m in December

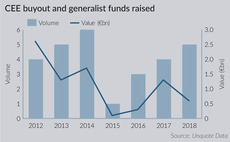

CEE fundraising activity promises buyout revival

Fundraising in the region held strong in 2018 in contrast to the rest of Europe and promises to be even stronger in 2019, even as dealflow slumped

Mezzanine Management backs Optimapharm with €10m

Transaction marks Mezzanine Management’s first investment in the Croatian market

CEE dealflow drops in H1 as exits soar

Buyout activity in the first six months of 2018 was at the lowest H1 level seen since 2009

EIF seeks manager for Croatian fund-of-funds

Selected fund managers will be expected to attract private capital to be co-invested

Bolt-on activity flourishes in CEE region

As the region continues its convergence with the west, a decrease in perceived risk is paving the way for increasing buy-and-build activity

EI acquires Studenac

Studenac aims to accelerate the development of its regional store network

Enterprise Investors acquires 65% stake in Pan-Pek

Transaction is the final investment made via the GP's Polish Enterprise Fund VII

Quaestus sells Metronet to Telekom Austria

Fund manager Quaestus exits its stake in the Croatian business after an eight-year holding period

Ambienta completes tertiary buyout of Calucem from Argus Capital

The GP will become the third private equity owner of the Croatian cement maker after Argus and Mid Europa

A country-by-country guide to investing in CEE

Part two of our CEE report, detailing the nuances of each country

Advent, EBRD in potential partnership to buy Hypo SEE

Potential sale of Balkan bank network still in early stages

ARGUS acquires Calucem in SBO

ARGUS Capital Partners has acquired the Croatian supplier of calcium aluminate cement Calucem from Mid Europa Partners.