IPO

VC-backed Shazam to pursue IPO

Shazam, a London-based mobile music recognition app developer, is to pursue an initial public offering.

CVC's Evonik begins listing process in Frankfurt and Luxembourg

CVC-backed Evonik Industries has begun its much anticipated listing process by issuing its 466 million shares simultaneously in Frankfurt and Luxembourg.

PE-backed Intelsat misses IPO target

Luxembourg-based satellite operator Intelsat SA, which is backed by BC Partners and Silver Lake Partners, fell more than $100m short of its target at yesterday’s close on the NYSE.

Apollo's Taminco in disappointing stock exchange debut

Shares in Taminco, the Belgian chemical business backed by Apollo, dropped by around 8% to $14.05 yesterday, shortly after the firm listed on the New York Stock Exchange.

Sofinnova's Omthera raises €48.8m in IPO

French investor Sofinnova Partners has completed the IPO of US-based portfolio company Omthera Pharmaceuticals on the Nasdaq Global Market in New York, raising €48.8m.

Enterprise makes 9x on Kruk

Central European investor Enterprise Investors has fully exited its investment in Kruk after a 10-year holding period.

CVC to list shares in bpost

CVC Capital Partners plans to list its shares in Belgian postal service bpost on the stock market and has already appointed banks to coordinate the sale, according to reports.

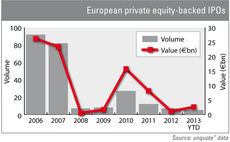

IPO activity dwarfs 2012 after first quarter

Private equity-backed IPOs are making a major comeback and could be set to reach their highest level since 2010, according to figures from unquoteт data.

Esure IPO gives firm £1.2bn market cap

Insurance provider Esure has completed its flotation on the London Stock Exchange, which gives it a market capitalisation of ТЃ1.2bn.

Northzone's Asetek becomes latest PE-backed IPO

Northzone's US-based company Asetek has listed on the Oslo Stock Exchange, the latest in a string of IPOs in Europe including Moleskine and Countrywide.

Countrywide's IPO pricing at top of range

Private equity-backed estate agent Countrywide has narrowed its IPO pricing at the upper end of its range.

Syntegra's Moleskine launches IPO

Syntegra Capital has launched the IPO of portfolio company Moleskine in a listing that could value the business at up to €530m.

CVC sells further shares in Evonik ahead of IPO

CVC and Rag Foundation have sold a further 4.6% stake in German chemicals business Evonik, reducing their stakes by around 6% each in total, ahead of a renewed attempt at listing the business.

IPOs "not best option" for private equity

While trade sales and secondary buyouts have been the most favoured exit route for private equity players, 2013 has seen renewed enthusiasm surrounding the public markets. Amy King reports from an ICAEW seminar on the IPO market

Moleskine to list this month

Notebook and diary brand Moleskine, owned by Italian GP Syntegra, will list on the Milan stock exchange this month.

Penta-backed Esure moves forward with IPO plans

Penta Capital's portfolio company Esure has confirmed its intention to list on the London Stock Exchange.

CVC places Evonik shares as IPO markets wake up

CVC is the latest GP taking a more flexible approach to exiting its businesses, selling a share in chemicals business Evonik to institutional investors in preparation for an IPO.

Moscow Exchange IPO sets market cap at $4.2bn

Private equity-backed Moscow Exchange (MICEX) has set its IPO offer price at RUB 126.9bn ($4.2bn).

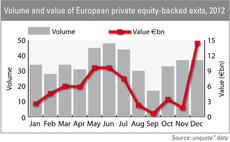

Exit market hits €15bn in December

Almost €15bn worth of capital was realised by private equity portfolio sales in December 2012, the highest amount in the past year, according to figures from unquote” data.

KKR and Permira looking to exit ProSiebenSat.1

KKR and Permira are looking to sell their stakes in German private broadcaster ProSiebenSat.1 to a trade buyer, according to reports.

Cinven and Warbug Pincus exercise Ziggo over-allotment option

Cinven, Warburg Pincus and their co-investors have announced the initiation of an over-allotment option for Dutch cable operator Ziggo.

Changes to IPO rules under discussion at Downing Street

Technology companies with high growth rates could be allowed to float just 10% of their business on the London Stock Exchange if proposals under discussion at Downing Street are accepted.

Top 5 exits of 2012 so far

Top 5 exits of 2012

The new dotcom bubble

The new dotcom bubble