Secondary buyout

Argos Soditic sells Alkan to TCR, IDI

Argos Soditic has sold Groupe Alkan, a French manufacturer of equipment for the aeronautical defence industry, to TCR Capital and IDI.

Montagu acquires Dorc from Rabo Capital

Montagu Private Equity has acquired Dutch Ophthalmic Research Center (Dorc) from Rabo Capital, the private equity division of Rabo Bank.

Omnes divests Melkonian in SBO

Omnes Capital has sold Melkonian Group, a French provider of mining equipment, to BPI France, Amundi Private Equity Funds and Sofipaca.

ICG picks up Equistone's APEM

Equistone Partners Europe has sold its majority stake in APEM Group to minority shareholder Intermediate Capital Group (ICG).

Stable markets and high liquidity to boost Nordic exits

The Nordic region saw disappointing dealflow in 2013, despite an open and liquid financing market - but the industry is upbeat on exit prospects for 2014. Karin Wasteson reports

Ciclad buys Slat from Initiative & Finance

Ciclad has acquired French producer of electrical power supplies Slat in a secondary buyout from Initiative & Finance.

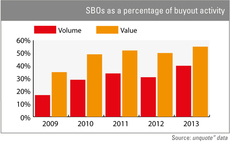

SBOs hit new peak in 2013

Secondary buyouts rose to new levels of prominence in the European market last year, accounting for 40% of all buyouts and 55% of aggregate buyout value. Greg Gille reports

HgCapital becomes fifth PE backer of Zenith

HgCapital has acquired car rental company Zenith Vehicle Contracts Group from Morgan Stanley Global Private Equity (MSPE).

Segulah acquires KP Components

Segulah has agreed to acquire Danish metal components provider KP Components.

Electra buys Hotter Shoes from Gresham

Electra Partners has acquired a majority stake in the secondary buyout of UK shoe manufacturer Hotter Shoes from Gresham Private Equity.

MBO Partenaires backs Cofigeo SBO

MBO Partenaires and Société Générale Capital Partenaires have acquired a stake in the buyout of French ready-meals specialist Cofigeo.

Gimv and Alsace acquire Wolf in SBO

Gimv and Alsace Capital have acquired French designer and manufacturer of women’s underwear Wolf Group from Cathay Capital and EPF Partners.

Inflexion reaps 3.5x on Optionis exit

Inflexion Private Equity has sold employment services company Optionis to MML Capital, realising a 3.5x multiple on its original investment.

Deutsche Private Equity buys Zellbios from Ergon

Deutsche Private Equity (DPE) has acquired Luxembourg-based pharmaceuticals firm Zellbios from Ergon Capital Partners.

Gilde sells Hofmann to Partners Group

Gilde Buy Out Partners has sold German catering company Hofmann Menü Manufaktur to Partners Group alongside Hofmann's management.

Siparex makes 5x on Manuloc exit

Siparex has sold its stake in French logistics business Manuloc to existing backer CM-CIC Capital Finance after more than 10 years as a minority shareholder.

ECI picks up Encore from Isis

ECI Partners has acquired West End ticket agency Encore Tickets from Isis Equity Partners, in a deal thought to be worth ТЃ60m.

LDC exits Leasedrive to HgCapital

LDC has sold a majority stake in vehicle management group Leasedrive to HgCapital in a secondary buyout.

Graphite purchases Sovereign's City & County

Graphite Capital has acquired home care provider City & County Healthcare Group from Sovereign Capital.

Dunedin unlocks £90m Kee Safety deal

UK mid-market firm Dunedin has backed the ТЃ90m management buyout of Kee Safety, buying its stake from LDC.

Deal in focus: Ardian and Consilium sell Rollon

In mid-November, after almost a year of negotiations, Ardian and Consilium sold Rollon, an Italian manufacturer of liner rails and actuators, to French GP Chequers Capital and Italian investor IGI.

Deal in focus: Seafort buys three firms from Auctus

Newly founded private equity house Seafort Advisers has kicked things off with a hat-trick of secondary buyouts from Auctus Capital Partners via a dedicated vehicle.

Gimv, UI Gestion acquire Almaviva

Gimv and UI Gestion have acquired French operator of private clinics Almaviva Santé from 21 Partners, with each of the firms contributing €40m towards the buyout.

Seafort Advisers buys three businesses from Auctus

Newly founded private equity house Seafort Advisers has bought packaging recycling company Noventiz, business services provider DialogFeld Communication and lighting manufacturer Dieter Braun from Auctus Capital Partners via a dedicated vehicle.