Secondary buyout

HIG Capital takes over Triton's Weru

HIG Capital has bought German windows and doors manufacturer Weru from fellow buyout house Triton.

Carlyle sells P&I to HgCapital in SBO

The Carlyle Group has sold German human resources software company P&I Personal & Informatik to HgCapital in a secondary buyout.

21 Partners backs Synerlab

21 Partners has acquired Synerlab Group, a French drug manufacturing and packaging company, from Ardian in a management buyout.

Ontario Teachers' Pension Plan to buy Burton's Biscuits

Ontario Teachers' Pension Plan has agreed to acquire UK-based Burton's Biscuits, which makes confectionery including Wagon Wheels and Jammie Dodgers, via its private equity arm Teachers' Private Capital.

Eurazeo to acquire Montefiore's Asmodée

Eurazeo has entered exclusive talks to acquire French party games publisher and distributor Asmodée from Montefiore Investment for an enterprise value of €143m.

Graphite sells Park Holidays to Caledonia for £172m

Graphite Capital has sold caravan park operator Park Holidays UK to listed trust Caledonia Investments for ТЃ172m.

Equistone makes 2.5x on sale of Allied Glass to CBPE

Equistone Partners Europe has sold Allied Glass back to previous owner CBPE Capital in a deal understood to be worth between ТЃ120-130m, generating a money multiple in excess of 2.5x.

Graphite makes 3.5x on Alexander Mann Solutions sale

Graphite Capital has sold Alexander Mann Solutions (AMS) for ТЃ260m to New York-based New Mountain Capital, reaping a 3.5x return on its initial investment.

Isis reaps 4.8x on sale of CableCom to Inflexion

Isis Equity Partners has sold CableCom Networking, a UK-based internet and digital media services provider, to Inflexion Private Equity, reaping a 4.8x return.

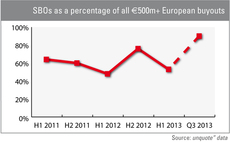

SBOs account for 90% of €500m+ dealflow in Q3

The latest quarterly figures from unquote" data show that while the wave of secondary buyouts seems to have hit its apex in overall volume terms, such deals are still disproportionally prominent in the large-cap space.

Advent secures Nocibé deal

Advent International and the Kreke family, which together own German retail group Douglas Holding, have entered exclusive talks to buy French perfume chain Nocibé from Charterhouse.

Equistone buys Européenne des Desserts in SBO

Equistone Partners has acquired French desserts maker Européenne des Desserts from Azulis Capital and Céréa Partenaire.

Equistone nears Européenne des Desserts SBO

Equistone Partners is set to acquire French desserts maker Européenne des Desserts from Azulis Capital and Céréa Partenaire, according to reports in the local press.

Nixen Partners et al. acquire Carré Blanc in SBO

Nixen Partners, BPI France and Crédit Agricole Régions Investissement (Carvest) have acquired a majority stake in Groupe Carré Blanc from MML Capital Partners and Qualium Investissement.

EdRCP sells Mediascience to Siparex

Siparex has led a consortium to wholly acquire Mediascience Group from Edmond de Rothschild Capital Partners (EdRCP).

Isatis injects €2.4m into Ispa MBO

Isatis Capital has invested €2.4m in the leveraged management buyout of French project management consultancy Ispa Consulting, in what marks the GP's last deal under the BNP Paribas Private Equity moniker.

Bridgepoint sells Terveystalo to EQT

Bridgepoint has sold Finnish private healthcare provider Terveystalo to EQT for a reported тЌ650m.

Towerbrook takes off with LDC's AIM Aviation

Towerbrook Capital Partners has acquired aircraft cabin interior designer and manufacturer AIM Aviation from LDC.

Carlyle acquires BTI from Valedo Partners

The Carlyle Group has acquired Swedish subtitling company Broadcast Text International (BTI) from Valedo Partners.

Bridgepoint buys AHT Cooling in €585m SBO

Bridgepoint has acquired AHT Cooling Systems, an Austrian manufacturer of refrigerators, from Quadriga Capital and Partners Group for €585m.

MML backs Tournus Equipement SBO

MML Capital Partners has acquired a stake in Tournus Equipement, a French manufacturer and distributor of stainless steel equipment for professional kitchens, from Qualium Investissement as part of a secondary management buyout.

Bregal buys proAlpha from Beaufort Capital

Bregal Capital has bought a majority stake in excess of 70% in proAlpha, a manufacturer of enterprise-resource-planning (ERP) software.

CVC acquires Domestic & General from Advent

CVC has agreed to buy insurance business Domestic & General (D&G) from Advent International, alongside management.

Equita sells Karl Eugen Fischer to Equistone

Equita has sold its majority stake in Karl Eugen Fischer (KEF), a German provider of cutting systems for tyres, to fellow private equity house Equistone Partners Europe.