Sofinnova

Sofinnova holds EUR 150m close for third biotech fund

Impact fund has made two investments as of its interim close and expects to make 10-12 in total

Consortium backs €38.75m series-B for Tissium

France-based wound dressing developer previously raised €30.5m at the series-A stage

French GPs opt for organic diversification

Recent fund closes show that organic diversification is still a valid option for some GPs and VCs willing to step out of their comfort zones

Sofinnova et al. invest €20m in Afyren

France-based biotech business Afyren plans to commercialise its products in 2020

Sofinnova et al. back €27m series-C for Limflow

BPI France and Balestier, a Singaporean family fund, also take part in the financing

Sofinnova closes biotech fund on $650m hard-cap

Fund's different generations have received a combined $2bn of committments in total

Sofinnova leads €22.5m Gecko Biomedical round

Extension to series-A round also includes BPI France, Omnes, CM-CIC Innovation and CapDecisif

Sofinnova and Imperial's Mission Therapeutics raises £60m

Investment led by Woodford Patient Capital Trust and saw existing backers re-up

Sofinnova et al. in €72.8m series-C round for Merus

Third largest round observed by unquote" in Benelux so far in 2015

VC backers divest GlycoVaxyn to GSK

Deal values biopharmaceutical company at $212m

VC-backed Ascendis raises $108m in IPO

Listing priced at $18 per share

Ascendis completes $60m series-D

A total of seven investors comitted capital to the round

Auris' delayed IPO lists below initial price range

Number of shares on offer increased by more than 35% but price almost halved

Sofinnova-backed Auris announces price range

Float expected to be worth between £69-82m

VC-backed OpenERP raises $10m

Company to rebrand as Odoo as part of the deal

Sofinnova leads CHF 32m round for ObsEva

Sofinnova Partners has led a CHF 32m series-A round for Swiss biopharma company ObsEva.

European venture: patience rewarded

Patience rewarded

Idinvest leads €34m round for Crocus

Idinvest Partners has led a €34m funding round for Crocus Technology, a French supplier of magnetic semiconductors and sensors, with participation from a consortium of new and existing backers.

Emerald Technology Ventures et al. back MetGen

Emerald Technology Ventures and several other backers have invested in a series-A financing round for MetGen Oy, a Finnish industrial biotech company.

CDC Entreprises and Sofinnova invest €8m in MedDay

CDC Entreprises and Sofinnova Partners have made an €8m equity investment in French biotech firm MedDay.

Aledia raises €10m in first funding round

Sofinnova Partners, Braemar Energy Ventures, Demeter Partners and CEA Investissement have participated in a €10m funding round for French LED developer Aledia.

CDC leads €10m round for McPhy Energy

CDC Entreprises has invested €5m as part of a €10m round for French hydrogen storage specialist McPhy Energy.

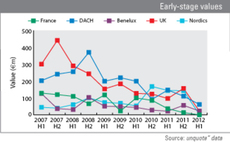

Declining activity belies venture successes

Although European venture capital activity decreased by 12% to €974m last year, 2011 saw a number of sizeable fund closes as well strong exits, indicating fresh appetite for the asset class.

Sofinnova promotes two team members

Venture firm Sofinnova Partners has promoted Rafaèle Tordjman from partner to managing partner and Alessio Beverina from principal to partner.