United Kingdom

Highland, Brookfield lead USD 100m round for Plentific

Mubadala Investment Company and existing investors including Target Global have backed the round

MML, 57 Stars invest GBP 20m in Natural World Products

MML Growth is backing the waste recycling and compost production firm via its EUR 135m second fund

VCs in USD 292m round for WorldRemit

Series E from Farallon, Leapfrog, TCV and Accel sees the firm rebrand as Zepz at a USD 5bn valuation

Bridges exits The Vet in trade sale

Exit is the firm's third since July 2021, following SBOs of Wholebaker and World of Books

Wm Morrison board accepts GBP 7bn CD&R offer

Deal would be the largest PE-backed take-private in the UK since Boots' GBP 11.1bn delisting in 2007

Inflexion to acquire Sunovion Pharmaceuticals Europe

Inflexion's previous pharmaceutical sector investments include Rosemont Pharmaceuticals

Charme, Livingbridge sell Witherslack to Mubadala Capital

Both Charme and Livingbridge are to retain minority stakes in the school and care home operator

Rutland acquires Southgate Global

Acquisition of the packaging company is the 11th platform deal from Rutland Fund III

Exponent to exit publisher Dennis in GBP 300m trade sale

Deal ends a three-year holding period and nets returns of more than 3x money and 40% IRR for the GP

Livingbridge acquires IT service North from Aliter Capital

Aliter Capital formed North via a buy-and-build strategy for portfolio company Boston Networks

Bregal Milestone to launch second fund

European growth technology investor held a final close for its debut vehicle in 2018 on EUR 400m

Wm Morrison shareholder JO Hambro to decline Fortress takeover offer

JO Hambro say the offer is below the 270p level that would be worthy of consideration

Novalpina to lose control of EUR 1bn debut fund

GP was founded in 2017 and is notably invested in Israeli spyware business NSO Group

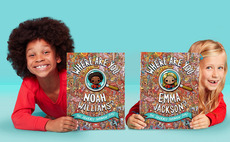

Graphite Capital acquires Wonderbly

Personalised children's books publisher is the seventh deal from Graphite's 2018-vintage ninth fund

Palamon exits Feelunique in GBP 132m sale to Sephora

Palamon acquired the UK-headquartered online beauty products retailer for GBP 26m in 2012

Baird Capital holds final close for second Global Fund

Vehicle will continue to back founder-led UK, US and Asian SMEs via buyout and growth deals

FPE invests in employee benefits software Zest

Deal is the 10th platform investment from FPE's GBP 100m, 2016-vintage, second fund

GHO holds EUR 2bn final close for third fund

Fund close follows a fully virtual fundraise that saw the GP surpass its EUR 1.25bn target

Silverfleet calls off fundraise for third fund

GP intends to focus on follow-on investments and realisations in its existing portfolio

McLaren confirms GBP 550m fundraising led by Saudi Arabia, Ares

Existing shareholders, including Mumtalakat, and new private investors invest GBP 150m

Nordic Capital buys majority stake in VC-backed Duco

Financial data management software raised USD 28m from VCs including Eight Roads and Insight in 2018

Revolut raises USD 800m Series E at USD 33bn valuation

Company becomes the second most valuable fintech in Europe, behind Sweden's Klarna

H&F holds USD 24.4bn final close for 10th fund

Large-cap buyout specialist closed its predecessor fund in October 2018 on USD 16bn

WestBridge exits AJM Healthcare to Livingbridge

WestBridge backed the MBO of the wheelchair and mobility service provider in September 2018