Articles by Harriet Matthews

Apollo makes first deal from Impact strategy

Apollo will launch a take-private bid for the recycled cardboard producer on completion of the deal

True holds £275m final close for third fund

Consumer-focused GP raised the fund in a six-month virtual process and surpassed its ТЃ250m target

Charterhouse to exit Siaci Saint Honoré to OTPP et al.

OTPP, Cathay, BPI France and Ardian back the deal and SSH's merger with market peer Diot

Montagu buys Waystone from MML

Acquisition of the fund advisory firm is Montagu's third SBO of 2021, according to Unquote Data

Charterhouse buys Labelium from Qualium

B2B digital marketing agency made six add-ons during Qualium's three-year investment period

Unigestion holds €611m final close for second Direct fund

Fund surpasses its тЌ600m target and is more than 40% deployed

Capiton buys majority stake in Axxence Group

GP is backing the natural aroma chemicals firm via Capiton VI, which is on the road targeting €550m

HarbourVest opens Frankfurt office

GP simultaneously announces the appointment of principal Martina Schliemann, who joins from Hamilton Lane

Evoco sells Plumettaz to Invision

Evoco bought the cable-laying equipment producer in a six-company portfolio deal in 2015

Karmijn Kapitaal holds first close for third fund

Netherlands-headquartered GP held a final close for Fund II in June 2016 on €90m

Livingbridge buys majority stake in VC-backed Semafone

Octopus Ventures and BGF exit the data security and compliance software developer

Five Arrows invests £120m in Causeway Technologies

Deal follows the GP's ТЃ300m SBO of Sygnature Discovery from Phoenix Equity Partners

Bridgepoint mulls London listing

GP could be valued at ТЃ2bn and is also planning fundraises for its Europe and Growth strategies

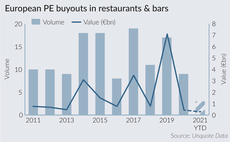

Pandemic sinks dealflow in restaurants & bars to 10-year low

Activity in the sector has not yet returned to previous levels, with four buyouts totalling тЌ285m recorded to date in 2021

Ashurst hires Dechert's Hellot

François Hellot spent 12 years as a partner with Dechert prior to joining Ashurst

Cross Equity, Pinova sell Rademacher to trade

GPs acquired the Germany-based smart home systems business in 2014 from Nord Holding

Perwyn buys majority stake in JT's IoT division

Jersey Telecom will retain a minority stake in the company, which is valued at ТЃ200m

ArchiMed buys Stragen Pharma

GP is investing via its €1bn Med Platform I, which backs healthcare firms with EVs of at least €100m

Argand, Genui-backed Cherry to float in €778m IPO

Computer hardware firm was valued at around €200m when Argand took a majority stake in 2020

Graphite Capital sells Performance Timber to trade

Acquisition by Bergs Timber values the company at SEK 140m and ends a 12-year holding period

Epiris sells Saunderson House in £150m trade sale

GP acquired IFG Group in 2019, subsequently splitting it into Saunderson House and James Hay

Riverside-backed Bike24 to list in €662m IPO

Riverside acquired Bike24 in 2015, selling it to Bridgepoint's Wiggle-CRC and buying it back in 2019

GP Profile: Palatine looks to B2B, continued ESG value creation

Managing partner Gary Tipper discusses the firm's deal pipeline, its focus on ESG, and how its portfolio has weathered the pandemic

High-Tech Gründerfonds to launch fourth seed fund

Fund expects to launch its official fundraising process in September 2021, subject to BaFin approval