Pandemic sinks dealflow in restaurants & bars to 10-year low

The restaurants and bars sector bore the brunt of the Covid-19 lockdowns over the past 15 months, with a correspondingly very low level of investment from private equity activity, according to Unquote Data.

Many fast food and restaurant chains suffered under the coronavirus lockdowns in place across much of Europe throughout the past year. Unquote reported on the challenges for the sector in April 2020.

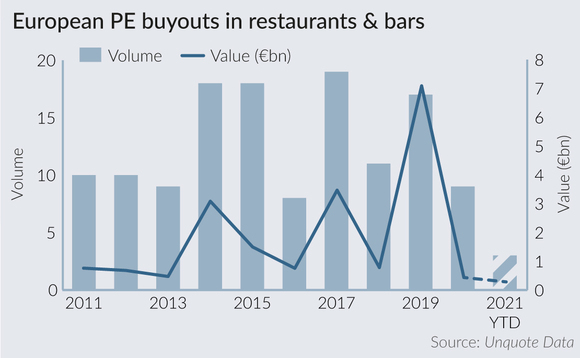

The restaurants and bars sector saw a record year for aggregate buyout value in 2019, with 17 deals totalling more than €7bn. While 2020 was not the worst year on record in volume terms, the pandemic led to a 10-year low in yearly aggregate buyout value in the sector, according to Unquote Data. The nine buyouts that took place in 2020 totalled €436.5m; these included Partners Group's acquisition of French restaurant chain Côte from BC Partners, as well as Epiris's acquisition of Casual Dining Group.

Activity in the sector has not yet returned to previous levels, with three buyouts totalling €285m recorded to date in 2021, according to Unquote Data. However, Yo! Sushi, a portfolio company of Mayfair Equity Partners, was considering an IPO in April 2021 following significant growth in the US, the Sunday Telegraph reported. The sector has also seen three exits to date in 2021; in April, TDR Capital-backed Euro Garages acquired Leon from Spice Private Equity and Active Partners in a deal valued at around £100m.

Selection of recent buyouts in the restaurants & bars sector

| Deal | Deal date | Deal value (€m) | GP | Fund |

| Sushi Yama | Mar 2020 | n/d (<25m) | Litorina Capital |

Litorina V |

| Brunchco21 | May 2020 | n/d (25-50m) | Cobepa Belgium; M80 |

n/d |

| The Big Table | Jul 2020 | n/d (50-100m) | Epiris |

Epiris Fund II |

| Azzurri | Jul 2020 | n/d (100-250m) | TowerBrook Capital Partners |

TowerBrook Investors V |

| Busaba Eathai | Jul 2020 | n/d (<25m) | TnuiCapital |

n/d |

| Chilango | Aug 2020 | 20 | RD Capital Partners |

n/d |

| Dat Backhus | Sep 2020 | n/d (50-100m) | PrecapitalPartners |

n/d |

| Sumo | Nov 2020 | n/d (25-50m) | Herkules Capital |

n/d |

| Comess Group | Dec 2020 | n/d (<25m) | GED Capital |

GED V España |

| Canas y Tapas | Jan 2021 | n/d (<25m) | Axon Partners |

n/d |

| Groupe ETLB | Feb 2021 | n/d (100-250m) | Montefiore Investment |

Montefiore Investment V |

| Lunch Garden | Apr 2021 | n/d (100-250m) | Intermediate Capital Group |

n/d |

Source: Unquote Data

With consumer demand expected to return to or even exceed previous levels once the coronavirus vaccination programme advances across Europe, Bridgepoint's recent investment in Itsu is also an indication of the prospect of returning stability for the sector.

The GP acquired a minority stake in the UK-based East Asian food chain, continuing its partnership with founder Julian Metcalfe following their Pret a Manger collaboration. Sky News reported that the deal could value Itsu at up to £100m. The investment in Itsu will back the company's growth plans, which will include the opening of 100 new sites and the creation of 2,000 jobs in the UK over the next five years, according to a statement. Although some of its centrally located sites have been closed since September 2020, Itsu said in the same statement that it hopes to reopen the remaining closed stores in the near future.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds