Benelux unquote

GP Profile: Apheon builds on family roots, mulls exits and reinvestment opportunities

Belgian GP, formerly known as Ergon, to continue to target family- and entrepreneur-owned European businesses

Eurazeo taps Rothschild for DORC exit

Upcoming process for Dutch medical equipment group expected to launch in September

Active Capital in EUR 150m fundraise; SIF strategy and portfolio companies eye buys

Industrials-focused sponsor expects reshoring trend to generate uptick in opportunities

Bencis prepares Kooi for sale via Lincoln

Netherlands-based video surveillance business was founded in 2010 and acquired by Bencis in 2018

Dutch VC NLC Health aims to raise a further EUR 80m for fourth fund

Plans to back companies created by NLC Venture Builder across medtech, biotech and digital tech

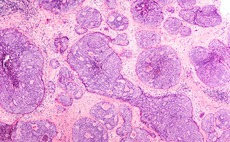

BioGeneration Ventures closes Fund V on EUR 150m

LP appetite for healthcare has remained strong in spite of a tough fundraising market

Dutch sponsor Egeria gears up for new fund launch next year

GP’s 2017-vintage, EUR 800m current fund is expected to be fully deployed within 12-18 months

Strada Partners heads for 2024 final close for EUR 150m debut fund

Emerging Belgian manager was formed last year and will ink deals with EUR 5m-EUR 50m equity tickets

Capvis-backed Gotha Cosmetics to grant PAI Partners exclusivity ‘in coming days’

Capvis took a majority stake in the Netherlands-based colour cosmetics firm in 2016

Eurazeo-backed DORC catches the eye of dealmakers with H2 process anticipated

Eurazeo acquired the Dutch ophthalmic surgical equipment producer for EUR 430m in 2019

Bugaboo backer Bain strolls back to market for H2 2022 launch

Sale of pram maker was initially launched last year but did not proceed due to credit market and consumer sector concerns

Egeria to exit GoodLife Foods in SBO to IK Partners

Acquisition of Dutch frozen snack maker marks 13th investment from IK IX Fund

Polestar Capital to raise up to EUR 500m for new e-mobility investment strategy

Dutch GP plans to close new vehicle in mid-2024 as Circular Debt fundraising continues

Heran Partners nears full deployment of debut fund, mulls next fundraise

Health tech-focused VC is seeking three further software and hardware deals from EUR 75m debut vehicle

Carbon Equity open to commitments for new impact fund with EUR 125m hard-cap

Netherlands-based fund-of-funds manager will broaden its strategy to incorporate co-investments for its second fund

Gimv acquires majority stake in Witec

Belgium-based Gimv set to support Netherlands-headquartered contract design manufacturer’s growth

4Impact heads for year-end close for EUR 125m second fund

Founded by ex-Goldman Sachs team, impact VC firm has made one investment from its latest fund so far

Forbion raises combined EUR 1.35bn for venture and growth funds

Ventures Fund VI closes on EUR 750m and Growth Opportunities II on EUR 600m with both upsized by over 60%

Gilde Healthcare hits EUR 600m target for Venture&Growth VI

Fund is 50% larger than predecessor thanks to “loyal” LP base; seeks late-stage deployment in medtech, digital health and therapeutics

Houlihan Lokey poaches Nielen Schuman’s Theys to open up Antwerp office

Hire to cement Houlihan Lokey’s position in Belgium, which represents 30% of the advisor’s Benelux deals

Mayfair kicks off third fund deployment with Jonckers buyout

Sponsor has seen a GBP 800m increase in AUM since its most recent exit in October 2022

Large-cap sponsors circle Qiagen bioinformatics arm ahead of indicative bids

Potential PE bidders are assessing performance and market share of the Netherlands-headquartered business

Bencis raises EUR 123m continuation fund for group of Fund IV assets

Secondary deal was led by Committed Advisors and will provide backing for future growth of four portfolio companies

Newton Biocapital heads for year-end close for second, EUR 150m life sciences fund

Belgian-Japanese VC has raised EUR 50m to date and is lining up exits from its debut fund