Refinancing

Unquote Private Equity Podcast: The PE auction in times of exit scarcity

Rachel Lewis joins Harriet Matthews to discuss how auction process dynamics are changing against the current market backdrop

Alcentra takes keys to three PE-backed companies this year

Under Benefit Street Partners' ownership the alternative lender took over Lifetime, Optionis and Equiom

Gyrus Capital's Essential Pharma refinances, inks two deals

In parallel with the refinancing, Essential Pharma completed two M&A deals in December

Searchlight invests in Celestyal Cruises

Searchlight is investing in the cruise operator via its Searchlight Opportunities Fund

Carlyle backs European strategies with ESG facility

Credit facility is linked to targets such as board diversity and greenhouse gas emissions monitoring

LBO France's Groupe RG completes impact refinancing

Reinancing for the PPE distributor includes ESG criteria that will affect the debt repayment

Oaktree provides €275m in financing to Inter Milan

Following the deal, Suning and LionRock pledge their stakes in the company as collateral

Investec provides ESG-linked NAV facility for Bluewater

Facility is related to the portfolio of Bluewater Energy Fund I, which closed in 2013 on $861m

Searchlight's Survitec completes refinancing

Ares' ТЃ270m package will be used in part to finance the add-on of IK's Hansen Protection

Palamon, Corsair in £165m dividend recap for Currencies Direct

GPs reportedly mandated William Blair in December 2020 to explore strategic options

Tikehau to become majority shareholder in Cruiseline

Following the deal, Montefiore retains a minority stake and a seat on the company's board

SVP's Klöckner Pentaplast completes €1.9bn refinancing

Strategic Value Partners bought the recycled products and packaging company from Blackstone in 2012

Idinvest backs refinancing of Quadriga's Kinetics

Quadriga acquired Kinetics in August 2011 - unitranche will in part to finance growth projects

Apse-backed Kallidus acquires Sapling

This is Kallidus's second acquisition following the purchase of Engage in Learning in March 2020

Triton announces merger of AVS, Chevron, Fero and Ramudden

Merger of Triton's four traffic services portfolio companies follows a refi earlier in December

Gyrus completes recap for DuPont Sustainable Solutions

First realisation since the GP's establishment in 2018 sees a 60% return on invested capital for investors

Kartesia in €32m refinancing for Enterprise-backed Nu-Med

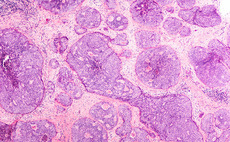

Enterprise Investors acquired a minority stake in the oncology company in 2013

Nordic Capital's Nordnet completes listing

IPO gives the company a market cap of SEK 24bn, compared with SEK 6.6bn at its take-private in 2017

CVC provides £37.5m financing for Sovereign-backed Nurse Plus

Sovereign Capital purchased Nurse Plus from previous sponsor Key Capital Partners in 2015

LBO France buys majority stake in Prenax

Andera has reinvested and Prenax has acquired LM Information's subscription management business

Investindustrial-backed Benvic completes €117.5m refinancing

Benvic has completed seven add-on acquisitions during Investindustrial's holding period

Borromin's ProFagus completes refinancing

Charcoal and natural additives company saw final bids from two banks and one direct lender

Rileys hires FRP to assist with rescue plan

Rileys CEO Craig Mayes confirmed the appointment of FRP to examine options going forward

Kartesia backs £26m refinancing for BGF-backed Clearway

Debt has been invested from Kartesia Senior Opportunities I, marking the fundтs first UK investment