Benelux activity picks up in first half of 2017

After a drop in activity in H2 2016, dealflow in the Benelux region picked up again in the first half of this year. Alice Tchernookova reports

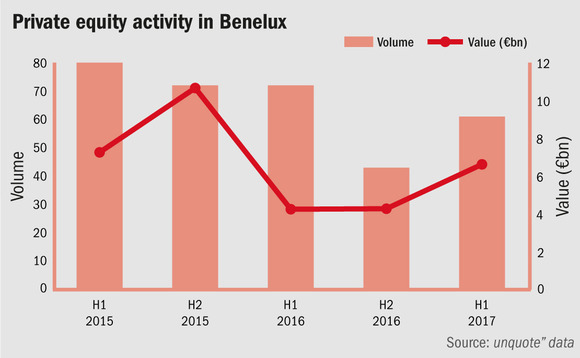

Following a rather slow second semester last year, the first half of 2017 suggests the Benelux private equity market is heading for brighter days. According to unquote" data, while a total of 29 buyouts were recorded in H2 2016, the first part of this year saw 34 transactions, with respective aggregate values of €3.95bn and €6.27bn, marking a significant jump.

Alexandre Neiss, who focuses on debt origination in the Benelux region for Investec's corporate and acquisition finance team, says: "We have seen strong dealflow in the region this semester. It's good to have seen it rebound after last summer's Brexit vote, which led to a rather quiet period and held back Q3 2016. The first couple of months of this year were quiet too, but there has been a big pick-up in activity since."

Nothing currently tells me that the markets are going to slow down [in H2] – we're seeing a lot of refinancings come through, with sponsors trying to recap while the market is hot" – Alexandre Neiss, Investec

However, Neiss notes that, given the majority of Benelux deals take place in the mid-market, mega-buyouts in H1 2017 have skewed aggregate deal values over that period. In particular, aluminium manufacturing company Corialis was acquired in March by CVC Capital Partners from Advent International for approximately €1bn, and parking operator Q-Park was wholly acquired by KKR Infrastructure for an estimated €2.95bn in May.

"From our point of view, the geography continues to be core," says Neiss. "At the moment, the lending markets are borrower-friendly, and it doesn't feel like that's likely to change any time soon.

"As for H2, nothing currently tells me that the markets are going to slow down – we're seeing a lot of refinancings come through, with sponsors trying to recap while the market is hot. I don't see any near-term events that could cause liquidity to move out of the market – and even if it did, the liquid end of the market would be affected first, rather than the mid-market, which is financed through bank balance sheets."

Time to exit

H1 2017 was also a particularly active period for divestments. According to unquote" data, 25 exits were recorded, with an aggregate value of €5.6bn. This represents a step-up compared to H2 2016, which saw 19 exits take place with €4.4bn of total returns.

Charly Zwemstra, managing partner at Main Capital, says: "There is an enormous momentum in exit activity – we expect very substantial exit proceeds in the second half of the year, both in the market as a whole and for us at Main, where we have a lot under way."

Meanwhile, Investec's Neiss argues the surge in exit activity is the logical effect of current market conditions: "Considering the leverage multiples currently achievable and the impact this is having on enterprise values, now seems to be a very good time to complete exits. The amount of available dry powder, and the low interest rate environment are driving high leverage, which in turn is pushing exit multiples to all-time highs."

Belgian power

Much of the increased activity witnessed in the region can be attributed to the growing importance of the Belgian market. Between January and June this year, 10 buyout transactions were closed in the country, representing €1.8bn in aggregate value. This is almost double the previous semester's six transactions worth €551m.

Three Belgian deals have already exceeded the €500m mark this year: CVC's Corialis, and The Carlyle Group's acquisitions of Præsidiad for an estimated €720m, and of ADB Safegate for an estimated €900m, both closed in July with the €3.75bn Carlyle Europe Partners IV fund.

Says Neiss: "Given the increased number of sponsors and banks or credit funds focused on the Benelux region has increased over the last couple of years, it doesn't surprise me that there's been a move towards the Netherlands' neighbouring countries to see if opportunities exist there too. Whether deals as significant as Corialis or Betafence will keep popping up is difficult to say, as Belgium remains a small market; but the interest in the country is certainly there."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds