GP Profile: Gimv

Recent investments in One Of A Kind Technologies and Ellis Gourmet Burger conclude a busy first half of the year for Gimv. Investor relations and corporate communications manager Frank De Leenheer speaks to Francesca Veronesi about the firm's legacy in the Belgian public sphere and its current investment strategy

"Gimv operates in a segment of the market that is usually covered by local firms, therefore distinguishing itself by providing European reach and expertise," says Gimv investor relations and corporate communications manager Frank de Leenheer, adding that the GP provides a good degree of flexibility. The firm acquires both majority and minority stakes, can provide subordinated loans with an equity kicker and has the ability to be flexible in terms of holding periods through its evergreen structure.

Founded in 1980 in Antwerp, Gimv is among the oldest GPs in continental Europe. The firm was launched on behalf of the Flemish government with the aim of creating a GP that would provide equity to local small-cap firms in the midst of the economic crisis experienced in Belgium at the time. Over time, the regional government decreased its stake in the firm: in 1997 it listed 30% of Gimv, in 2005 it decided to reduce its stake again to around 40% and in 2006 it reduced it further to 27%. Today Gimv is listed on Euronext Brussels with a valuation of €1.3bn.

The GP has offices in Antwerp, The Hague, Paris and Munich, and the majority of companies backed are located in Belgium, the Netherlands, France and Germany – though it has made some investments in Switzerland. As of Q1 2018, the GP managed 54 companies, with Gimv's stake in these assets valued at €960m. In terms of assets under management, the firm totals around €1.6bn.

The GP typically provides equity tickets in the €5-50m range to European companies with enterprise values of up to €150m. It operates via four main sector-specific investment strategies – connected consumer, health and care, smart industries, and sustainable cities. Separate investment teams, composed in part by professionals who previously worked in these industries, are dedicated to each investment strategy.

Finding the perfect blend

Gimv employs a hybrid model with regard to the organisation of its funds. It has a listed vehicle with a solid balance sheet, alongside closed-ended funds for specific strategies to which third party money is committed. The listed vehicle is also a cornerstone investor for each of Gimv's closed-ended funds. The only active sector-specific vehicle managed by the firm is its health and care fund, which closed in March 2015 on €150m.

Gimv opts to invest from either its balance sheet, closed-ended funds, or both, according to pre-agreed strategies and fixed co-investment proportions. It has no immediate plans to raise new closed-ended funds as its listed vehicle is currently cash-rich with €380m of dry powder available.

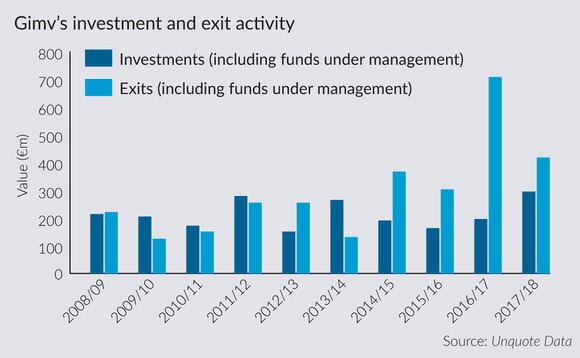

From April 2017 to March 2018, the deal value of investments from its balance sheet amounted to €246m, though adding the dealflow of closed-ended funds this rises to €295m. Its exits during the same period totalled €371m, rising to €418m including closed-ended funds. Gimv's listed vehicle has generated a net IRR of close to 12% over the course of the past 38 years. Its closed-ended funds have provided, on average, a net IRR of 14%.

Gimv completed 11 investments and seven exits in 2017, while in Q1 2018 the firm made six investments and one exit. Between 2014 and 2016, it completed 13 exits, and says that 87% of the value created from these was generated by pure growth. Of the remainder, less than 13% was accounted for by "multiple expansion" strategies and less than 1% by leverage-related factors. Over the course of the period, a total money multiple of 3.6x was generated, while investments generated 2.4x on average.

Gimv's LP base is much consolidated, being composed of 25 Belgian institutional investors that have backed the firm for a long period of time, some since its foundation" – Frank De Leenheer, Gimv

Discussing Gimv's LP base, De Leenheer explains how some investors have continued to back the firm since its inception. "Gimv's LP base is much consolidated, being composed of 25 Belgian institutional investors that have backed the firm for a long period of time, some since its foundation," he says. "Some of these LPs are also shareholders of Gimv." The listed vehicle has a broader geographical make-up, with a considerable number of European and US-based shareholders.

Two particular success stories are the firm's investments in and subsequent exits from French private hospital group Almaviva Santé Group in October 2017 and German CGI specialist Mackevision in January 2018. Almavia's turnover increased from €100m to €350m during the investment period, while Mackevision's increased by around 50% per year, with the investment generating an IRR of more than 40%.

The firm backed Netherlands-based One Of A Kind Technologies, a group of high-tech companies focusing on machine vision, and Belgium-based chain Ellis Gourmet Burger in early May. It intends to help the former expand abroad and the latter to consolidate its presence in the Belgian, Dutch and French markets. During the course of the past two months, it has also completed add-on acquisitions for portfolio companies WEMAS Absperrtechnik, Contraload and SGH Healthcaring.

De Leenheer sees growing competition, partially created by family offices and new GPs, as the main current challenge in Gimv's markets. "[Gimv has] proceeded to increase the percentage of deals sourced on a one-to-one basis," he says of the firm's response to the challenge. "As a consequence, currently just half of our deals are sourced via an auction, significantly less compared to even just a couple of years ago."

Discussing the changing debt landscape in the Benelux, with alternative debt funding becoming more and more accessible, De Leenheer specifies that the firm uses low leverage for its investments: "This is linked to our focus on high-growth companies, leaving them enough money to finance their own growth and expansion, rather than diverting the attention of management to the deleveraging of their balance sheet."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds