Benelux unquote" April 2010

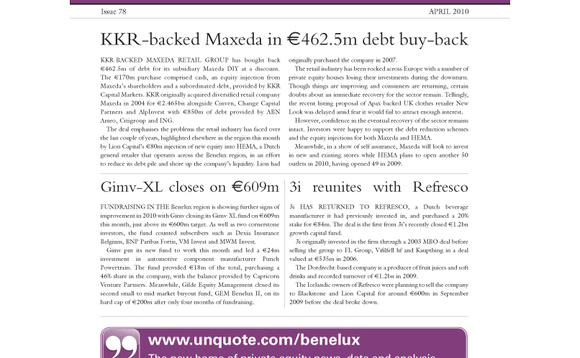

If there is one rule that prevails over private equity commentary nowadays, it is that determining any long term trend remains extremely difficult; such is the volatility in the market. The effect on the retail sector is particularly evident. KKR-backed Maxeda bought back €462.5m of debt for its subsidiary Maxeda DIY at a discount.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds