Buyouts

JC Flowers buys Eurovita for €47m

JC Flowers has acquired a 79.6% stake in life insurer Eurovita Assicurazioni from listed insurance firm Aviva and Banco Popolare for €47m.

Ardian and Consilium sell Rollon

Ardian and Consilium have sold Rollon, an Italian manufacturer of liner rails and actuators, to French GP Chequers Capital and Italian private equity firm IGI.

Argos Soditic buys Cisbio Bioassays

Argos Soditic has backed the €25m management buyout of French biotech company Cisbio Bioassays.

Ontario Teachers' Pension Plan to buy Burton's Biscuits

Ontario Teachers' Pension Plan has agreed to acquire UK-based Burton's Biscuits, which makes confectionery including Wagon Wheels and Jammie Dodgers, via its private equity arm Teachers' Private Capital.

August buys The Old Deanery Care Village

August Equity has acquired Essex-based care home business The Old Deanery Care Village.

Advent offers €1bn to take Unit4 private

Advent International has put in a €1.17bn offer to take Dutch software company Unit4 private in a deal that would value the whole business at €1.28bn.

Steadfast Capital acquires AVS Group

Steadfast Capital has bought a majority stake in traffic safety provider AVS Group from the firm's owner.

Vitruvian backs RL360 carve-out

Vitruvian Partners has backed the management buyout of Royal London 360 (RL360) to allow the subsidiary to split from its parent company Royal London Group (RLG).

Eurazeo to acquire Montefiore's Asmodée

Eurazeo has entered exclusive talks to acquire French party games publisher and distributor Asmodée from Montefiore Investment for an enterprise value of €143m.

Omnes Capital backs Camérus MBO

Omnes Capital has acquired furniture rental business Camérus Group in a management buyout.

BlackFin buys HyperAssur and creates Comparadise

Financial services-focused investor BlackFin Capital Partners has acquired online insurance comparison site HyperAssur, as it continues to consolidate the financial aggregator market in France.

EQT scoops up German bakery BackWerk

EQT has bought a majority stake in German bakery chain BackWerk from the company's founders.

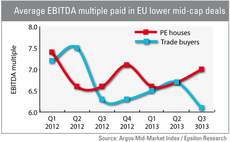

Lower mid-cap uptick bolsters valuations

Private equity buyers have been more bullish than their corporate counterparts on pricing in the third quarter, according to the latest Argos Mid-Market Index. Greg Gille reports

NorthEdge invests £25.5m in Fine Industries

NorthEdge Capital has invested ТЃ25.5m in Teesside-based Fine Industries, a manufacturer of fine chemicals.

Adelis closes fund and acquires Logent

Adelis has agreed to acquire Logent, a Nordic logistics services provider, alongside the companyтs existing management shortly after closing its maiden fund on тЌ420m.

ECI sparks Harvard Engineering deal

ECI Partners has acquired a minority stake in Harvard Engineering, a developer of control systems for the lighting industry.

Mobeus and Connection toast Virgin Wines deal

Mobeus Equity Partners and Connection Capital have invested a combined ТЃ15.9m of debt and equity to support the management buyout of Virgin Wines.

Graphite sells Park Holidays to Caledonia for £172m

Graphite Capital has sold caravan park operator Park Holidays UK to listed trust Caledonia Investments for ТЃ172m.

Equistone makes 2.5x on sale of Allied Glass to CBPE

Equistone Partners Europe has sold Allied Glass back to previous owner CBPE Capital in a deal understood to be worth between ТЃ120-130m, generating a money multiple in excess of 2.5x.

European private equity activity drops to 2005 lows

Findings from the latest unquote” Private Equity Barometer, published in association with SL Capital Partners, reveal a worrying drop in deal volumes, falling to the same level as Q4 2005.

Ardian provides unitranche for Européenne des Desserts buyout

Ardian (formerly Axa Private Equity) has arranged a €70m unitranche facility to finance Equistone's buyout of Européenne des Desserts from Azulis Capital and Céréa Partenaire.

Bencis to take Xeikon private

Bencis Capital Partners has made a mandatory public offer to acquire all issued shares of Xeikon for €5.85 per share, giving the company an enterprise value of €168m.

Via Venture Partners in Procom MBO

Via Venture Partners has invested in Danish wireless communication business Procom alongside the company's management.

Babson Capital provides mezz for Teachers' Busy Bees

Babson Capital Europe has provided a mezzanine facility to support the ТЃ220m acquisition of UK nursery chain Busy Bees by Teachersт Private Capital last week.