Lower mid-cap uptick bolsters valuations

Private equity buyers have been more bullish than their corporate counterparts on pricing in the third quarter, according to the latest Argos Mid-Market Index. Greg Gille reports

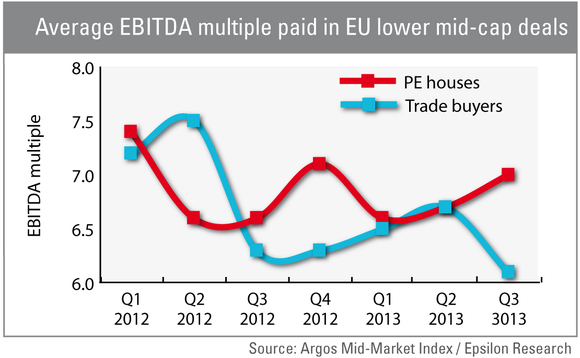

GPs paid a median entry multiple of 7x EBITDA in lower mid-market buyouts – here defined as deals valued in the €15-150m range – according to the Q3 Argos Mid-Market Index, published by Argos Soditic and Epsilon Research. This is the second quarterly rise in a row this year, and virtually on par with the 7.1x median multiple witnessed in Q4 last year.

Meanwhile, the median multiple paid in similar corporate M&A transactions fell back to 6.1x after three quarters of continuous improvement. This is the largest differential seen between both types of buyers since Q2 2012, although corporate buyers were out-spending GPs then.

However, Argos Soditic partner Gilles Mougenot warns the trends could soon cross again. "I wouldn't read too much into the apparently contrasting pricing trends between LBOs and corporate M&A," he told unquote". "For one, the stock market uptick means the slump noticed with corporate buyers shouldn't last. On the other hand, the 'flight-to-quality' syndrome is still in full effect when it comes to private equity buyers: a handful of really attractive transactions generate a lot of competition and command high prices, while many, more problematic assets, are pulled off the market altogether."

GPs in exit mode seem acutely aware of this, and the phenomenon is exemplified by a change in attitude when it comes to "start-stop" sale processes, says Mougenot: "Many players don't hesitate to test the market by launching processes, pulling the sale if there is not sufficient appetite, and potentially trying again at a later date. Furthermore, it doesn't seem to be tarnishing their image, which would have been unthinkable in previous years – provided that the reasons are explained, of course. If anything, proving that you took advantage of the extra time to deleverage or further improve trading metrics can be a positive down the line."

Mid-cap recovery

Private equity houses may still be focusing their efforts on the best assets, but the combination of significant amounts of dry powder and a growing sense of optimism on macroeconomic indicators throughout Europe means activity in the lower mid-market improved significantly in Q3. Dealflow in the €15-150m range went up by 50% in volume terms compared to Q2, according to unquote" data, while the overall value of these deals increased by 43% to reach €4.3bn.

"Overall, the market has shown signs of picking up in Q3 after six quarters of lacklustre activity, notably on the LBO side," notes Mougenot, before adding that not all European countries are set to benefit equally from the improvement: "France is struggling in that regard, though – not in absolute terms but compared to its European neighbours. The tumultuous political and economic context, combined with the negative impact of fiscal instability, means the mood in the local market remains pretty bleak."

The full Argos Mid-Market Index can be viewed here.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds