Buyouts

Nazca buys Agromillora

Nazca Capital has acquired Spanish plant propagation firm Agromillora.

Axa PE and Fosun to acquire Club Med for €540m

Axa Private Equity and Fosun International have agreed to wholly acquire listed French holiday resorts group Club Méditerranée alongside the company's management for around €540m.

Ratos acquires majority stake in Hent for NOK 310m

Ratos has agreed to acquire close to 73% of Norwegian construction company Hent for NOK 310m.

Mid Europa acquires Polish Cable Railways for PLN 215m

Mid Europa Partners has wholly acquired Polish Cable Railways (PKL), Poland’s oldest cable car provider, from the state-owned Polish State Railways (PKP) group for PLN 215m.

Charterhouse enters Italian market, buys Doc Generici

Charterhouse Capital Partners has wholly acquired Italian pharmaceutical firm Doc Generici, marking the GP’s first transaction in the Italian market, according to reports.

TowerBrook buys majority stake in Kaporal 5

TowerBrook Capital Partners has acquired a majority stake in French clothing retailer Kaporal 5.

Ace invests €8m in Asquini-Sofop Aero

Ace Management has made an €8m investment to back the merger of French aerospace parts manufacturers Asquini and Sofop.

GMT and Veronis buy IT-Ernity from Nedvest

GMT Communications Partners and Veronis Suhler Stevenson have bought a majority stake in IT-Ernity from Nedvest Capital.

Nordic private equity hushed but hopeful

Nordic PE

AnaCap sells Cabot to JC Flowers

AnaCap Financial Partners has sold Cabot Credit Management (CCM) to JC Flowers in a secondary buyout worth a reported ТЃ800m.

BlackFin backs finanzen.de

BlackFin Capital Partners has invested in finanzen.de AG, taking a majority stake in the business.

HIG kicks off Nordic activity with Freedom Finance buyout

HIG Europe has completed its first investment in the Nordic region with the acquisition of consumer loan broker Freedom Finance Nordic.

PE and trade players neck-and-neck on mid-market pricing

Mid-cap valuations

3i sells HTC Sweden to Polaris Private Equity

3i has sold its 36.5% stake in flooring solutions manufacturer HTC Sweden to Polaris Private Equity.

PAI partners sells FTE Automotive to Bain, reaps 3.3x overall return for fund III

PAI partners has agreed to sell its 90% stake in German hydraulic clutch and brakes provider FTE Automotive to Bain Capital in a secondary buyout.

EQT to acquire IP-Only for SEK 680m

EQT has agreed to acquire IP-Only Telecommunication AB, a Swedish fibre-based data communication provider.

Equita acquires MEN Mikro Elektronik

German private equity house Equita has acquired MEN Mikro Elektronik, an embedded electronics manufacturer, in a deal that values the company at €25-50m.

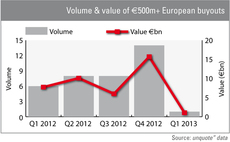

Q1 Barometer: Deal value hits four-year low

Q1 Barometer

Large-cap market awakens after tepid Q1

European buyouts valued in excess of €500m have been conspicuous in their absence in the first quarter following a flurry at the tail-end of 2012 – but recent weeks have shown signs of a revival.

3i sells Civica to Omers Private Equity

3i has sold specialist IT systems and services firm Civica to Omers Private Equity for an enterprise value of ТЃ390m.

CCMP acquires Pure Gym

CCMP Capital Advisers has backed Pure Gym's management in a secondary buyout of the UK-based company, which previously received funding from Magenta Partners.

Foresight backs Procam MBO

Foresight Group has backed the MBO of Procam TV, a UK broadcast hire company.

ECM acquires MediFox Group

ECM Equity Capital Management has acquired MediFox Group, a German software provider for the care industry, alongside management as part of a succession solution.

Isis backs MBO of Red Box

Isis Equity Partners has invested ТЃ14m in digital recording specialist Red Box Recorders as part of a management buyout.