Buyouts

Bridgepoint buys Flexitallic Group from Eurazeo

Bridgepoint has acquired Paris-based sealing solutions business The Flexitallic Group from Eurazeo PME for €450m.

Elysian Capital buys Axis Well Technology

Elysian Capital has backed the management buyout of Aberdeen-based oil and gas consultancy Axis Well Technology.

Electra to reap 15x on Allflex

BC Partners has made a binding offer of $1.3bn to Electra Partners for its French animal tags business Allflex, following an intense auction process that attracted bids from a dozen private equity firms.

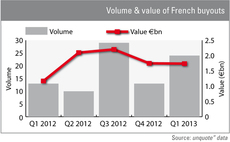

French buyouts up 50% YoY in Q1

The French buyout market enjoyed a much welcome uptick at the start of 2013, with both volume and overall value significantly up on Q1 2012 figures.

Argos seals Sage subsidiaries deal

Mid-cap GP Argos Soditic has completed the all-equity acquisition of four software-focused subsidiaries of Sage in France and Spain.

Invision buys Kraft & Bauer

Swiss firm Invision Private Equity has bought German fire protection business Kraft & Bauer Brandschutzsysteme (K&B) as part of a succession solution.

Panoramic invests £1.8m in Andante Travels

Panoramic Growth Equity has injected ТЃ1.8m into archaeological travel operator Andante Travels via its maiden fund, Panoramic Enterprise Capital Fund I (PECF I).

Isis backs Sage Construction MBO

Isis Equity Partners has backed the MBO of Sage Construction from software company Sage (UK) Ltd.

Charterhouse buys Armacell for €500m

Charterhouse has agreed to acquire German insulation company Armacell from Investcorp in a €500m secondary buyout.

FF&P Private Equity acquires FIT

FF&P Private Equity has backed the buy-in management buyout (BIMBO) of specialist energy efficiency firm Food Industry Technical Ltd (FIT).

PAI scoops up R&R Ice Creams

French large-cap specialist PAI partners has struck a deal to buy British ice cream manufacturer R&R Ice Cream from Oaktree Capital for тЌ850m.

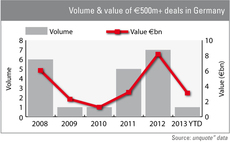

Germany: large-cap deals on the rise

CVC’s €3.1bn buy-back of German metering business Ista this month has sparked speculation about a revival of Germany’s large-cap market.

Bridgepoint leads Cote auction

Bridgepoint has emerged as the front-runner in the bidding process for UK-based restaurant chain Cote, which is expected to sell for ТЃ100m, according to reports.

German activity sluggish despite mega-deals

German activity

UK government considers private equity route for Royal Mail

CVC, Carlyle and KKR are among the firms that have been approached by government advisers regarding a potential buyout of Royal Mail, according to media reports.

Argos Soditic buys Natural Distribution

Argos Soditic has backed the buy-in management buyout (BIMBO) of UK-based food supplements specialist Natural Distribution.

Main Capital acquires Connexys

Main Capital Partners has acquired a majority stake in Dutch software company Connexys.

ICG buys Euro Cater from Altor

Intermediate Capital Group (ICG) has bought Danish food service company Euro Cater in a secondary buyout from Altor Equity Partners and inco Amba.

Warburg Pincus buys stake in Inea

Global private equity firm Warburg Pincus has acquired a minority stake in Polish cable operator Inea SA.

Q1 activity hits five-year low

The UK & Irelandтs first-quarter activity levels are at their lowest level for five years, according to the latest research from unquoteт data.

Aquiline buys Equity Insurance Group

US investor Aquiline Capital Partners has acquired Brentwood-based motor insurer Equity Insurance Group from Insurance Australia Group.

NorthEdge acquires Help-Link

NorthEdge Capital has acquired a stake in Leeds-based central heating specialist Help-Link UK Ltd.

LDC backs £50m MBO of D&D

UK-based LDC has acquired restaurant group D&D London in a ТЃ50m management buyout.

Bowmark buys Drake & Morgan

Bowmark Capital has backed the ТЃ30m management buyout of UK-based restaurants operator Drake & Morgan.