Large-cap market awakens after tepid Q1

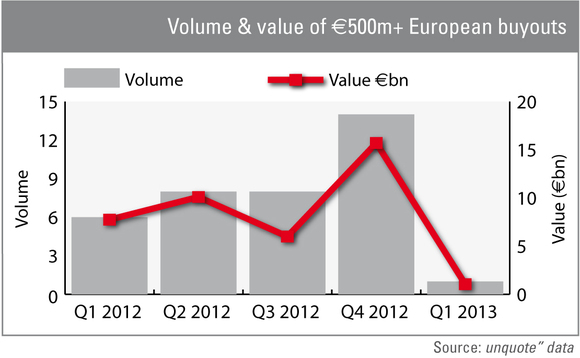

European buyouts valued in excess of €500m have been conspicuous in their absence in the first quarter following a flurry at the tail-end of 2012 – but recent weeks have shown signs of a revival.

European private equity activity figures for the first three months of 2013 reveal a stark drop in deal-making following a comparatively hectic Q4 last year, most of which was concentrated on the buyout market: private equity-backed buyouts fell by 23% from 102 to 79 deals, while the value total plunged 68% from €23.4bn to €7.5bn.

Most of that jarring difference in aggregate value can be traced back to large-cap activity – or the lack thereof. Just one transaction was recorded in the €500m+ segment in Q1 – Rhone Capital's acquisition of Dutch bakery supplies business CSM, valued at €1.05bn – against 14 deals worth an overall €15.7bn in the last three months of 2012.

But it would seem that the tide has started turning in this second quarter. So far, unquote" data has recorded six large-cap transactions since the beginning of April, collectively valued at nearly €7.2bn.

The standout transaction in this busy April came courtesy of CVC: the GP bought back German metering business Ista from Charterhouse for €3.1bn. April also saw another long-awaited transaction coming to fruition: PAI partners struck a deal to buy British ice cream manufacturer R&R Ice Cream from Oaktree Capital for €850m.

For a more in-depth look at Q1 2013 activity figures, click here to read the latest unquote" Private Equity Barometer in full.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds