Buyouts

TDR Capital backs MGM Advantage spin-off

TDR Capital has supported the spin-off of annuity specialist MGM Advantage.

Blackstone et al. circle Electra's Allflex

Electra Partners' livestock identification company Allflex has attracted interest from a dozen private equity firms, including Blackstone, Carlyle and Bain Capital, according to reports.

Carvest to buy Rave from Naxicap and Siparex

French transportation services group Rave is reportedly about to be sold by Naxicap and Siparex in a tertiary LBO backed by Carvest.

Sun European Partners leads Dreams race

Sun European Partners looks close to acquiring UK-based beds retailer Dreams for around ТЃ35m.

Montagu Private Equity sells ADB to PAI partners

Montagu Private Equity has sold Belgian airport lighting specialist ADB Solutions to PAI partners.

DMB acquires Wilhelm Stoll Maschinenfabrik

Deutsche Mittelstand Beteiligungen (DMB) has acquired German front loaders manufacturer Wilhelm Stoll Maschinenfabrik.

Naxicap and Siparex buy IPC

Naxicap and Siparex have acquired a majority stake in French cleaning products supplier IPC from Ciclad and private holding MFGI.

PAI looking to buy R&R Ice Cream for up to €1bn

PAI partners has edged closer to buying British ice cream manufacturer R&R Ice Cream from Oaktree Capital, according to reports.

PPM Oost sells Pharmaline to Gilde Healthcare Partners

PPM Oost has sold its stake in Dutch medical supplies company Pharmaline to Gilde Healthcare Partners.

Portugal's export credentials lure GPs back

Portugal's export edge

Partners Group invests in Softonic

Partners Group has invested in Spanish multi-platform software guide Softonic.

CGS takes majority stake in Top-Werk Group

CGS Management has invested in the merger of SR-Schindler Maschinen Anlagentechnik GmbH and Prinzing GmbH Anlagentechnik und Formenbau, which together will form the Top-Werk Group.

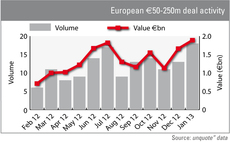

Lower mid-market buyouts hit €2bn record in January

France and the UK led Europe in January in the lower mid-market, which saw 18 such transactions across Europe worth a combined €1.9bn - the largest monthly value witnessed for a year. Greg Gille reports

Mid-cap valuations pick up in Q4 2012

Mid-cap valuations

NorthEdge backs FPE Global in maiden deal

NorthEdge Capital has taken a majority stake in UK-based engineering firm FPE Global.

NBGI acquires Stiplastics

NBGI Private Equity has acquired French packaging company Stiplastics.

Nordic Capital acquires Ellos

Nordic Capital Fund VII has agreed to acquire Swedish home shopping companies Ellos and Jotex from Redcats, a wholly-owned subsidiary of French company PPR.

DBAG backs MBO of Formel D GmbH

Deutsche Beteiligungs AG (DBAG) has invested in the management buyout of German support services company Formel D GmbH.

Elbrus buys OSG Records Management from Aurora Russia

Elbrus Capital has acquired Russian storage and records company OSG Records Management from Russian investment company Aurora Russia.

Equistone to buy Meilleurtaux

Equistone has entered into exclusive negotiations with French banking group BPCE regarding the sale of real estate mortgage adviser Meilleurtaux.

Litorina et al. invest in Kontorsvaruhuset Gullbergs merger

Litorina Capital Partners has backed a merger to form the new group Kontorsvaruhuset Gullbergs, a Swedish supplier of office wares and related services.

Connection Capital and Riverside buy the Cresta Court Hotel

Connection Capital and Riverside Capital have teamed up to acquire the Cresta Court Hotel in Altrincham and its operating company Harrop Hotels in a ТЃ2.95m MBI.

Argos Soditic to buy four Sage subsidiaries

Mid-cap GP Argos Soditic has entered exclusive negotiations with Sage Group regarding the acquisition of four of its software-focused subsidiaries in France and Spain.

CVC, BC Partners to team up for Elior bid

UK-based private equity houses CVC Capital Partners and BC Partners are reportedly planning a €3.5bn bid for French catering company Elior.