Buyouts

WHEB Partners backs Hoffmeister Leuchten

WHEB Partners has invested in German low-energy lighting business Hoffmeister Leuchten GmbH.

Clessidra buys Buccellati

Clessidra has bought a 70% stake in Italian jewellery firm Buccellati via the holding company Buccellati Holding Italia.

Rhône Capital buys bakery businesses for €1.05bn

Rhône Capital has agreed to take private the bakery supplies businesses from listed Dutch food ingredients group CSM for an enterprise value of €1.05bn.

Ratos et al. acquire Nebula Oy

Ratos, alongside Rite Ventures and the company's management, has agreed to acquire Finnish cloud services provider Nebula Oy for тЌ82.5m.

LDC backs £12m MBO of Validus-IVC

LDC has invested in the ТЃ12m MBO of UK-based claims management and counter-fraud software specialist Validus-IVC.

Eurozone shows greater appetite for Turkish delight

Turkish delight

Deutsche Beteiligungs AG acquires Stephan Machinery

Deutsche Beteiligungs AG (DBAG) has acquired German business Stephan Machinery, a manufacturer of food processing machinery, in an MBO valued at €40m.

Abénex buys RG Safety from Salvepar

Abénex has agreed to acquire French protection equipment RG Safety from industrial holding Salvepar.

Lower mid-cap renaissance for London in 2012

London was home to a noticeable dealflow uptick in the ТЃ5-50m segment last year, with both activity volume and overall value up by more than 30% on 2011 figures.

TA Associates invests in Onlineprinters

TA Associates has backed German printing business Onlineprinters.

Alpha Associés invests in ECS Group MBO

Alpha Associés Conseil has taken a stake in the secondary management buyout of French services provider to the air transportation industry European Cargo Services Group (ECS) from Chequers Capital, Equistone Partners and Indigo Capital.

ECM acquires Bergmann Automotive

Equity Capital Management (ECM) has acquired a majority stake in German industrial business Bergmann Automotive, alongside management and the company's family owners.

Fondations Capital buys Mazarine from LBO France

Fondations Capital has acquired French communications agency Mazarine in a secondary buyout from LBO France and 123Venture.

LDC marks hat-trick with Ramco investment

LDC has backed the buyout of Scotland-based oil & gas services business Ramco, the third deal announced by the firm in quick succession.

LDC backs NRS Healthcare MBO

LDC has taken a stake in the ТЃ24m management buyout of NRS Healthcare, the healthcare division of listed multi-channel retailer Findel plc.

Arlington backs MB Aerospace MBO

Arlington Capital Partners has backed the secondary management buyout of UK- and US-based aerospace engineering group MB Aerospace from LDC.

Mobeus backs Gro Group MBO

Mobeus Equity Partners has invested in the management buyout of nursery brand Gro Group.

Patron et al. in Cala Group bolt-on

Patron Capital Partners and Legal & General Group have agreed to acquire UK-based home builder Cala Group Ltd for ТЃ210m.

Marks & Spencer circled by Qatar-led consortium

Iconic British retailer Marks & Spencer could be the target of an ТЃ8bn takeover by a Qatar Investment Authority-led consortium, which could also include private equity players such as CVC, according to reports.

Latour Capital buys Oxand

Latour Capital has taken a majority stake in the buyout of Oxand, a French engineering and consulting firm specialised in the risk-based management of industrial infrastructure.

EdRip and BNP Paribas to back RBI spinout

Edmond de Rothschild Investment Partners (EdRip) and BNP Paribas Développement have entered exclusive negotiations to back the management buyout of French media group Reed Business Information (RBI) from its parent company Reed Elsevier.

Vendis backs Alexandre de Paris

Vendis Capital Management has taken a stake in the buyout of French hairdressing salon and cosmetics company Alexandre de Paris, in what marks the GP's first investment in France.

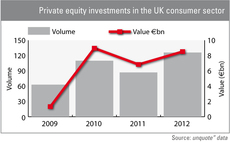

UK consumer sector: private equity dealflow up 45% in 2012

High street woes notwithstanding, the UK consumer sector proved to be ripe for investment opportunities last year: private equity dealflow was up by 45% compared to 2011 figures while the overall value of these investments rose by a quarter.

Equistone seals Brétèche Industrie deal

Equistone has completed the acquisition of a majority stake in French food machinery business Groupe Brétèche from Azulis Capital and Unigrains.