Buyouts

Pinova buys management stake in Clarus Films

Munich based Pinova Capital has announced that it has bought a 65% stake in Clarus Films GmbH from previous managing shareholder Dr Sven Dracker.

YFM backs £2m MBI of Selima

YFM Equity Partners has backed the management buy-in of Sheffield-based company Selima Limited in a ТЃ2m deal.

French SBO boom: no end in sight?

France’s booming buyout market is being fuelled by a glut of SBOs. However, more primary deal activity will be needed to maintain the market’s momentum. Greg Gille reports

Atlas Capital completes MBO of Adea

Atlas Capital has acquired 98.2% of Adea, the document management subsidiary of Spanish IT firm Indra, for around €15m. The transaction includes both equity and debt.

Global Cleantech Capital invests in Eyefreight

Global Cleantech Capital has invested in Dutch freight management company Eyefreight.

Phoenix acquires Gall Thomson Environmental

Phoenix Equity Partners has acquired liquid product transfer equipment manufacturer Gall Thomson Environmental from trade player Lupus Capital.

RCapital invests in Matrix Knowledge

RCapital has invested in TMKG Ltd and its subsidiaries, including information management service provider Matrix Knowledge.

Reiten & Co buys Competentia

Reiten & Co has taken a majority stake in Norwegian oil and gas consultancy Competentia.

CVC & Vista head-to-head on Misys bid

Another bidder for FTSE 250 banking software company Misys has dropped out, leaving two private equity bidders in the race.

Reiten & Co acquires Con-Form

Reiten & Co has acquired a 62% stake in Norwegian prefabricated concrete manufacturer Con-Form.

Alto Partners acquires Trevisanalat

Alto Partners has acquired Italian mozzarella producer Trevisanalat. The acquisition was completed through the formation of a newco, in which Alto holds a 77.2% stake.

Montezemolo acquires Bellco

Montezemolo & Partners SGR has acquired biomedical company Bellco from Argos Soditic and MPVenture.

Nord Capital and Turenne back Kap Verre MBI

Nord Capital Partenaires, Turenne Capital and Alliance Entreprendre have backed the management buy-in of French glass specialist Kap Verre from its co-founders.

Zurmont Madison acquires majority stake in AKAtech

Zurmont Madison Private Equity has acquired a 55% stake in Austrian electromechanical assembly and manufacture firm AKAtech Produktions.

Matrix hits grand slam for deals, exits in 2011

As the downturn drags on, most GPs are laying low and hoarding cash. One small buyout house stood out for achieving four investments and four new exits in 2011 т and has just announced its independence. Kimberly Romaine reports

Chamonix and Electra acquire Peverel from administrators

Chamonix Private Equity and Electra Partners have announced a ТЃ62m acquisition of property management services company Peverel Group from administrators Zolfo Cooper.

FF&P backs MBO of British company CreditCall

FF&P and Bestport Ventures have taken a majority stake in British payment technology business CreditCall.

OEP buys Linpac Allibert

One Equity Partners (OEP) has wholly acquired Linpac Allibert, the returnable transport packaging business of Linpac Group.

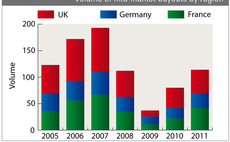

French mid-market continues steady climb

French mid-market buyouts staged a startling recovery last year, confirming that the 2010 uptick wasn’t a fluke – but can they keep climbing back to historical levels in the face of a tough environment? Greg Gille reports

VCT MBOs must continue, says ICAEW

Proposed changes may strip VCTsт of their ability to back buyouts т but this would have dire consequences, according to ICAEWтs CF head. Kimberly Romaine reports.

Fondations buys Buffet Crampon from Argos Soditic

Fondations Capital has entered exclusive negotiations to acquire French musical instruments maker Buffet Crampon from Argos Soditic.

3i acquires majority stake in cosmetics packager Geka

3i has bought a majority stake in German cosmetics packaging company Geka from mid-market investor Halder.

Unquote" Regional mid-market barometer

The latest Unquote" Regional mid-market barometer, produced in association with LDC, shows recovery was bolstered by prospering small caps in 2011, with total value of over ТЃ5.4bn across 166 deals.

Mid-cap valuations still stuck on pre-crisis levels

Activity nosedived in the second half of 2011, but the flight-to-quality phenomenon translated to very little movement on the entry multiples front. Greg Gille reports