French mid-market continues steady climb

French mid-market buyouts staged a startling recovery last year, confirming that the 2010 uptick wasn’t a fluke – but can they keep climbing back to historical levels in the face of a tough environment? Greg Gille reports

GPs have been working diligently to restore the French mid-market to its pre-Lehman crash glory; dealflow in the €50-250m bracket has doubled year-on-year from 2010 onwards in both volume and overall amounts invested, according to unquote" data. With 41 deals worth an overall €4bn recorded last year – despite a much tougher deal-making environment from August onwards – France has recovered spectacularly from the paltry activity levels witnessed in 2009 (11 deals worth €976m) and finally surpassed 2008 figures.

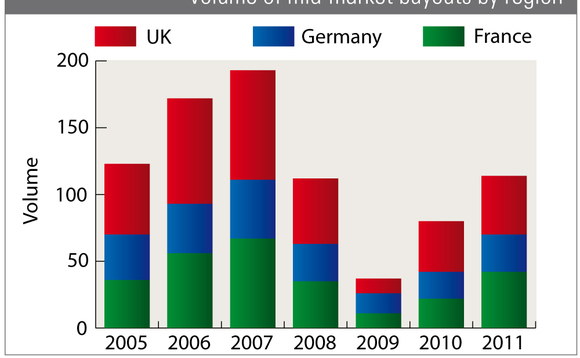

By comparison, most other European countries saw mid-cap activity level out in 2011. The UK mid-market in particular seemed to have run out of steam following a strong recovery in 2010 – when activity trebled compared to a record-low in 2009. Dealflow in the UK's €50-250m range increased by a modest 15% in volume and 12.5% in overall value last year; the 44 transactions worth a total of €4.5bn were not enough to match 2008 activity levels.

As a result, France took an unprecedented market share of European mid-cap activity last year. The country was home to a quarter of all €50-250m deals in Europe, a significant improvement on the 15.8% figure seen in 2010 and the 18.5% it averaged over the past five years.

Eric Bismuth, president of French lower mid-cap buyout house Montefiore Investment, highlights France's strengths in this segment: "Strong deal volumes show that the French mid-market is among the deepest in Europe. It benefits from a strong vendor base of private equity firms that are here to stay and will put many assets on the market in the coming years. Besides, much work remains to be done to facilitate generational changes in mid-sized businesses. The French economy is perhaps more open in that regard compared to Germany, but remains less mature than the UK and therefore presents good untapped potential for private equity."

Maintain momentum

While year-end figures paint a very impressive picture, activity in the French mid-market declined significantly in the last few months of 2011. The current mood in Paris is not exactly buoyant as dealflow has yet to show significant signs of improvement in the New Year. "The first month of 2012 showed similar subdued dealflow to that already witnessed in Q4 last year," notes Bismuth, who nevertheless adds that the first signs of a gradual recovery are starting to emerge: "We are however starting to see the pace accelerate, which could result in upcoming activity levels being higher than previously anticipated."

One of the factors to watch closely will be secondary buyout activity. SBOs accounted for a hefty 59% of deal volumes in the €50-250m range last year – one may fear that some of the best private equity-owned assets will have already swapped hands, leaving GPs working to scout promising but harder to spot businesses. This may result in lower activity figures, but could also favour a shift towards quality rather than quantity. Last year's SBO wave was partly driven by the timing of fundraising efforts; a number of larger players – including Astorg Partners, Apax France and Chequers Capital – raised new vehicles last year and will therefore enjoy more leeway to focus on the best-quality assets as investment period deadlines get pushed back.

Financing of course remains one of the most pressing issues that could make or break the ongoing mid-cap recovery – at least at the upper end of the segment. "Financing larger deals remains complicated," warns Bismuth. "Industry participants are therefore waiting for a couple of high-profile transactions to close, in order to gauge the market. The political context doesn't help, creating uncertainty ahead of the upcoming presidential election."

At the lower end of the mid-market, France has always benefited from a strong network of regional banks happy to fund the local businesses they have been working with for years. If anything, argues Bismuth, the current political climate is actually quite positive for lower mid-cap financing: "The issue of enabling access to financing for SMEs is high in the order of priorities for the two major candidates, but also for French banks. Financing lower mid-cap deals or build-up operations for existing portfolio companies is therefore less of an issue and we are enjoying great support from banks on this front."

Trimming down

With such conflicting signals and lack of visibility, it might take a few more weeks to properly gauge the French mid-market's prospects: dealflow took a while to really get going last year, with the first quarter of 2011 appearing subdued compared to the sudden acceleration witnessed in Q2 and Q3.

Even if activity levels fail to match 2011's impressive uptick, the ongoing restructure of the French GP base could make 2012 a very interesting year nonetheless. "The French mid-market was once perceived as very significant and attractive, but also as one of the most competitive in Europe. This is changing in quite a radical fashion, notably in the lower end of the segment – the polarisation is very noticeable, with regards to both activity levels and fundraising," says Bismuth.

Although it is seldom publicised, GPs that performed poorly in the downturn are progressively winding down. Meanwhile, strong performers seem to be attracting funds relatively easily and may find that their best vintages are still ahead, as they reap the benefits of a less crowded market.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds