Buyouts

HIG Europe takes stake in Losberger

HIG Europe has acquired a majority stake in tent and hall systems provider Losberger Group.

Carlyle acquires Brintons Carpets

The Carlyle Group has bought carpet manufacturer Brintons Carpets for ТЃ36m from its private owners.

3i buys Etanco off IK

3i has acquired a majority stake in French building fasteners manufacturer Etanco from IK Investment Partners.

PE-backed MBO for MB Electronique

Avenir Entreprises and CM-CIC Capital Privé have backed the management buyout of French electronic equipment distributor MB Electronique.

Bridgepoint secures Infront Sports & Media buyout

Bridgepoint has wholly acquired Swiss sports marketing agency Infront Sports & Media from private shareholders for approximately €600m.

Sentica takes 75% Kotipizza stake

Sentica Partners has acquired 75% of Finnish restaurants group Kotipizza.

123Venture et al. in Vérifimmo MBI

123Venture, LCV Finance and David Hamelin have wholly acquired French insurance business Vérifimmo for an undisclosed amount.

Nord Holding buys WEMAS

Nord Holding has acquired WEMAS Absperrtechnik, a provider of safety equipment for construction sites.

Nordic unquote" September 2011

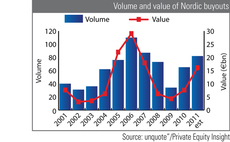

Buyout activity in the Nordics could return to levels seen pre-credit crunch, according to unquoteт research. If Nordic deal activity continues at the pace seen in the first half of 2011, volume and value look set to almost reach 2007 levels, marking...

Barclays acquires IN tIME Express Logistik from ECM

Barclays Private Equity has bought IN tIME Express Logistik from ECM Equity Capital Management.

Bridgepoint acquires four businesses from Hampson

Bridgepoint Development Capital (BDC) has acquired four businesses from Hampson Industriesт Aerospace Components & Structures division for $84m.

Gimv acquires Studiekring

Gimv has acquired a majority stake in Dutch tutoring service provider Studiekring.

HIG Europe signs off Bezier MBO

HIG Europe, the European arm of private equity firm HIG Capital, has acquired a majority stake in UK marketing services provider Bezier as part of a management buyout.

CFH backs DMB buy-in

CFH Beteiligungsgesellschaft has acquired a 50% stake in metal manufacturer DMB Metallverarbeitung GmBH in a management buy-in.

Ersel nabs Arbo from Quadrivio

Italian SME investor Gruppo Ersel has acquired an 80% stake in Accessori Ricambi Bonazzoli (ARBO) from fund manager Quadrivio in a secondary buyout.

Darwin in £50m Attenda SBO

Darwin Private Equity has backed the ТЃ50m management buyout of UK-based hosting services business Attenda from M/C Partners.

Syndication woes spell trouble for German buyouts

At a time when many GPs have finished divesting their vintage portfolios and are looking for fresh investments, the German leverage market is experiencing difficulties with loan syndication, threatening future buyouts. Diana Petrowicz investigates

Astorg leads FCI unit auction

French mid-cap firm Astorg Partners has entered into exclusive negotiations to acquire FCI's microconnections division from Bain Capital, according to sources close to the transaction.

CVC acquires majority stake in Virgin Active

CVC Capital Partners has acquired a 51% stake in fitness chain Virgin Active. The remaining 49% stake will be retained by Virgin Group.

Bregal buys Novem from creditors

Bregal Capital has acquired troubled automotive supplier Novem.

PE takes key role in financial services consolidation

With Cinvenтs acquisition of Guardian Financial Services this week, we are once again reminded of the pressure facing financial services organisations and the opportunities this presents for private equity investors.

Nordic buyouts set to return to 2007 levels

Buyout activity in the Nordics could return to levels seen in 2007, according to unquoteт research. If Nordic deal activity continues at the pace seen in the first half of 2011, volume and value look set to fall just short of 2007 levels, marking a resurgence...

Newcomer DTI makes debut UK investment

New York-based DTI Capital has backed the ТЃ4m buyout of London-based WTG, unquoteт has learned.

Perusa Partners buys Bactec

Private equity house Perusa Partners has acquired explosive ordnance contamination service provider Bactec.